Can We Expect The Economy To Keep Growing?

By Gail Tverberg

01 May, 2012

Our Finite World

If we read the financial pages, economic growth seems to be viewed as the “normal” situation to which economies inevitably return. But is it really?

If we look back over the past 50 years, or even over the past 100 years, economic growth has predominated. Over the longer term, we know that people have become more prosperous, and that world population has grown. The natural assumption is that economic growth will continue in the future as it has in the past.

Let’s think about this a little further. We live on an earth with a fixed surface area. If the population of the earth keeps growing, at some point people would fill up every square foot (or square meter) of land space. Clearly that can’t happen. Also, the resources we pull from the ground aren’t unlimited–at some point the amount we pull from the ground starts to deplete. We know that at some point, perhaps far in the future, economic growth must stop.

The question is really where we are now, relative to the hard limits that we know must exist. Let’s think about the situation.

What is needed to produce goods and services?

If we are going to have an economy, we will need goods and services. What do we need to produce these goods and services? While there are standard breakdowns (for example, land, labor and capital), the following is a different approach to the breakdown:

1. Human ingenuity. Animals don’t provide goods and services; humans do. Human ingenuity is needed to think of ways of combining materials and energy of various forms to provide goods and services.

2. Materials. Goods and services don’t come from thin air. Even if the product in question is a service, materials of various types are likely to be needed–a place for the worker to work, perhaps heated and cooled; a computer for the worker; transportation to and from work; and food for the worker. If food is to be produced, the soil must be of good quality, appropriate minerals must be in the soil, and fresh water must come at appropriate times.

3. Energy sources. ”Work,” typically involving some type of movement or heat, has to be performed to make the service or goods appear. This work is performed by some combination of humans, animals and machines. A human worker needs food as an energy source so he can perform the work of typing on computer keys. Similarly, in parts of the world where draft animals perform work, they need food as their energy sources. Machines operate with various kinds of energy inputs. If electricity is used, it can be generated in many different ways. Other forms of energy include fossil fuels (coal, natural gas, and oil), wood burned as fuel, wind energy, solar energy, nuclear energy, water energy, ethanol and other biofuels, and geothermal energy.

4. A way to pay for goods and services. In the earliest days, people lived in small groups. If one person was able to catch a large animal for food, the animal was shared freely with the group. In this case, there was no need for a system to pay for goods and services.

Once we start moving to larger numbers of people, some type of financial system is needed. If investments in large factories are to be made, a financial system must be available to accumulate past savings, so that they can be used to pay for the factories. Alternatively (or in addition), debt financing must be available, to promise to use the profits to pay for the factory in the future. There must also be a way for individuals to purchase goods and services sold. David Graeber in Debt: The First 5,000 Years talks about the relatively complex systems that were in place many years ago.

Has Economic Growth Always Been Possible?

If we look back through history and pre-history, what we see is a long struggle against limits of various kinds. Many societies collapsed, but the general world trend has been upward. Some examples of the kinds of struggles we see include the following:

A recent article in American Scientist talks about the fact that the Neanderthals and Modern Humans were both alive at the same time in Europe and the Middle East between 45,000 and 35,000 years ago, but the Neanderthals went extinct while Modern Humans survived. According to the author, anthropologist Pat Shipman, current analysis suggests that modern humans were able to domesticate dogs to help them in their hunting, and this greatly increased the amount of meat they were able to catch, while Neanderthals did not. So, even at this early date, humans were able to use their ingenuity to find their way around apparent limits, and were able to use the energy and skills of another species to supplement their own hunting skills.

In the Neolithic period, starting about 7,000 BC, early farmers were able to increase the amount of food available per acre by shifting from being hunter-gatherers, and thus support a larger world population. This was not entirely an advance, however. Hunters and gatherers were running into limits because they had killed off some of the game species. While agriculture allowed a larger population, the health of individual members was much worse. Average height of men dropped by 6.2 inches, and the median life span of men dropped from 35.4 years to 33.1 years, according to Spencer Wells in Pandora’s Seed: The Unforeseen Cost of Civilization.

Many societies have collapsed, as documented by Jared Diamond and by Joseph Tainter. Sing Chew in The Recurring Dark Ages talks about the recurring setbacks that took place within individual societies because of ecological stress and climate change. According to Chew, deforestation was a problem from at least 3,000 BC onward. Farming practices damaged the soil. Periods of collapse allowed natural systems to regenerate after ecological damage and changes in climate took place. Since not all societies collapsed at once, the system as a whole was able to continue.

Wars are also tied to lack of resources, energy or otherwise. Plunder in itself was often a major objective for medieval wars. Charles Hall and Kent Klitgaard in Energy and the Wealth of Nations talk about Japan’s need for resources, particularly oil, being a major reason for it role in World War II. According to Ugo Bardi, Italy’s lack of coal played a role in its involvement in the same war. Many have suggested that oil resources played a role in the United States’ involvement in Iraq.

Forces that Have Enabled Economic Growth to Date

If we look back through history, it is possible to see several forces that enabled long-term economic growth.

1. Agriculture, starting about 7,000 BC, and later the Green Revolution. The invention of agriculture allowed world population to grow from something less than 100,000 hunter-gatherers world-wide, to about 225 million at the time of Christ. In a “settled” state, financial systems and trade developed.

The Green Revolution took place between the 1940s and the late 1970s. It involved the development of high-yielding varieties of grains, expansion of the use of irrigation in farming, modernization of management techniques, and distribution of hybrid seeds, pesticides, and synthetic fertilizers to farmers. It is credited with saving over 1 billion people from starvation.

2. The development of an integrated world economy. The development of international trade started very early. Chew writes that by the late third millennium BC, sailors were able to sail from northwestern India to the eastern Mediterranean region. By the time Abraham left Ur of the Chaldeans around 2000 BC (mentioned in Genesis 11:31 of the Old Testament), Ur was a major city-state and center of long-distance trade.

Over time, trade expanded. During the 15th and 16th century, Spain and Portugal pioneered exploration of the globe, and built large overseas empires. They were followed by England, France and the Netherlands. In part, these empires helped the more advanced economies to extract wealth from less advanced economies, but these empires also fostered the growth of new more advanced economies, such as the United States.

In recent years, international trade has played an even larger role, with many international businesses and the development of the World Trade Organization. The availability of materials and services from around the world has allowed a kind of synergy to take place. Technology developed in one part of the world can be used with technology developed in other parts of the world. Materials from diverse parts of the world can be combined to make high-tech goods such as computers and electric vehicles.

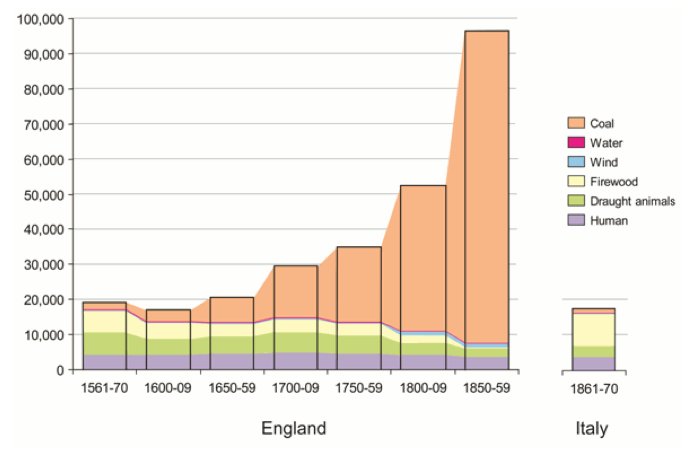

3. The Development of Fossil Fuels (Coal, Oil and Natural Gas). As mentioned previously, environmental degradation was a huge problem from at least 3,000 BC onward, because wood could not provide enough energy for growing populations. Figure 1, below, shows even at a much later date, water power and wind power did not provide much energy either. Because “renewables” did not provide enough energy for growing populations, other fuels were sought out.

Peat moss began to be used in the Netherlands for fuel in the 12th and 13th century. Peat moss is theoretically renewable, but its regeneration takes hundreds of years.

By the mid-16th century, coal was added to the fuel mix in Europe, and its use greatly expanded thereafter.

Figure 1. Annual energy consumption per head (megajoules) in England and Wales 1561-70 to 1850-9 and in Italy 1861-70. Figure by Tony Wrigley from Opening Pandora's Box. Figure originally from Energy and the English Industrial Revolution, also by Tony Wrigley.

Coal was the power that was behind the English industrial revolution. The summary that accompanies Wrigley’s book from which Figure 1 is taken says,

The industrial revolution transformed the productive power of societies. It did so by vastly increasing the individual productivity, thus delivering whole populations from poverty. In this new account by one of the world’s acknowledged authorities the central issue is not simply how the revolution began but still more why it did not quickly end. The answer lay in the use of a new source of energy. Pre-industrial societies had access only to very limited energy supplies. As long as mechanical energy came principally from human or animal muscle and heat energy from wood, the maximum attainable level of productivity was bound to be low. Exploitation of a new source of energy in the form of coal provided an escape route from the constraints of an organic economy but also brought novel dangers. Since this happened first in England, its experience has a special fascination, though other countries rapidly followed suit.

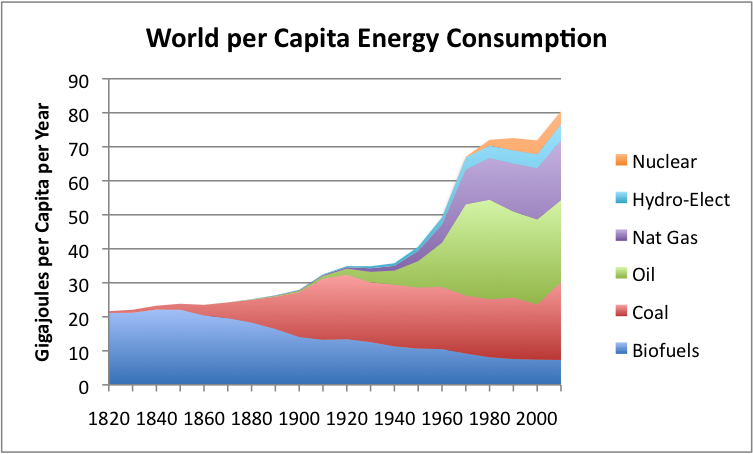

After coal was discovered, the power of oil and natural gas were also discovered. Oil was in many ways superior to coal: it was a liquid, so it could be easily dispensed and easily transported in vehicles, it was more “energy-dense” than coal and natural gas, so the size of the tank could be smaller, and after oil was refined, it was cleaner burning than coal. It was more expensive than coal, but it quickly became the transportation fuel of choice. Use of coal, oil and natural gas led to huge economic and population growth (Figure 3).

Figure 2. Per capita world energy consumption, calculated by dividing world energy consumption (based on Vaclav Smil estimates from Energy Transitions: History, Requirements and Prospects together with BP Statistical Data for 1965 and subsequent) by population estimates, based on Angus Maddison data.

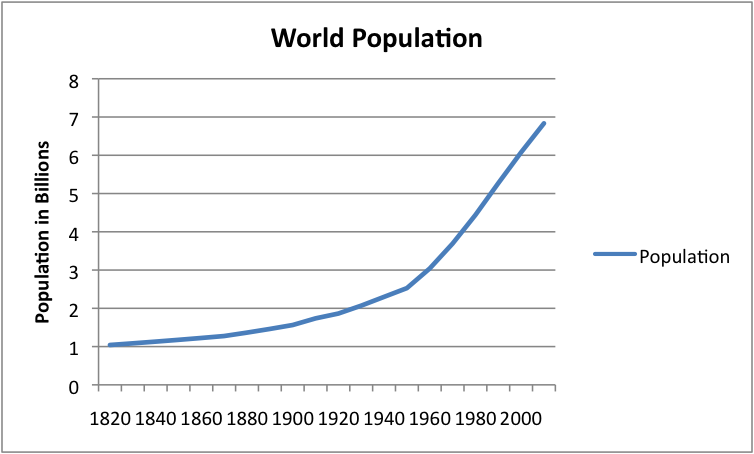

A comparison of the timing of world population growth (Figure 3, below) with the transition to oil as a fuel (Figure 2, above) shows that the surge in population growth that stared about 1950 corresponded to the huge increase in per capita oil consumption, and also to the timing of the Green Revolution mentioned above.

Figure 3. World Population, based on Angus Maddison estimates, interpolated where necessary.

4. More Education. Another force that helped enable long-term economic growth was a trend to greater education, since a better-educated population could better use new technology and would be able to handle more advanced jobs. As an example, during the first half of the 20th century, literacy rates in China were only 15% to 20%. Now, according to the CIA World Factbook, China’s literacy rate is 92%.

5. Aggressive Use of Debt Financing. This is different kind of issue that really has only come into play since World War II. It has to do with giving people and businesses credit to buy goods and services that they could otherwise not afford. It is really an accounting issue.

The way economic growth is calculated in Gross Domestic Product (GDP) calculations only considers whether new goods and services have been produced, not whether additional credit was extended to allow a factory to be built, or to allow a consumer to buy the new product. For example, if you are given the opportunity to buy a newly built house or new car on credit, the value of the new house or car that is built adds to reported GDP, but there is no adjustment to remove the new debt that allowed you to buy the new car or house.

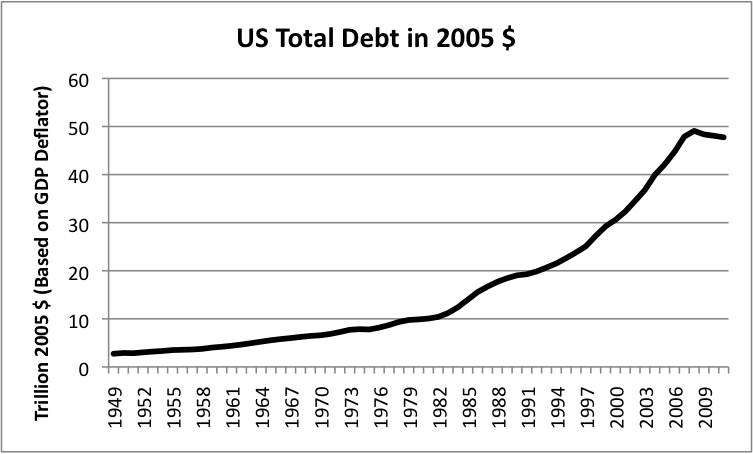

Since World War II, economists have been aware of the connection between additional debt and reported economic growth, and have tried to encourage the use of more debt. If the economy is growing, this debt would likely be easy to repay, because of growing sales for a manufacturer, and better job opportunities for a worker. Figure 4 below shows the total amount of debt in the US economy, for governments, businesses and individuals combined in 2005$.

Figure 4. Total US debt in 2005 $, based on Federal Reserve z1 data. Includes all types of debt. Adjustment to 2005$ based on US Bureau of Economic Analysis data.

This debt grew rapidly (in constant 2005$) until 2008, but has since been declining.

Limits We Are Now Hitting

While the five areas listed above have helped enable long-term economic growth, we are now reaching limits in all of them. Thus, while these factors have tended to create growth in the past, the same factors cannot be relied on to produce growth in the future. In fact, they may lead to a turn around in the not-too-distant future. Let’s look at them individually:

1. Agriculture and Later the Green Revolution. While agriculture and the Green Revolution enabled much more production of food in the past, we have now pretty much exhausted how far these efforts can go. Increased irrigation has led to depleted aquifers and more land with high salinity. In addition, cropland is increasingly being used for biofuels, leaving less land to grow crops for people.

The issue would not be so serious, except that population continues to grow, as the result of better sanitation and better medical care. The United Nations projects that world population will reach 10 billion by 2100 (from 7 billion now), even if birth levels gradually decline.

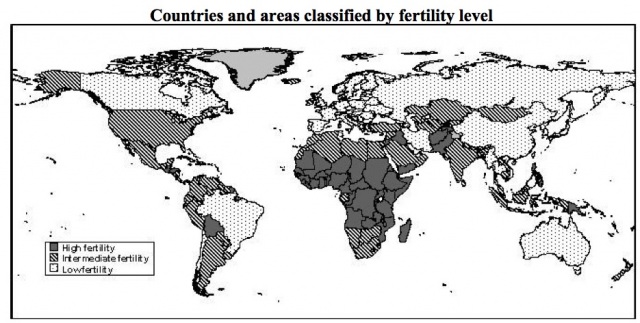

Figure 5. United Nations' figure showing countries and areas classified by fertility level. Low level corresponds to each woman having less than 1 daughter who survives to the age of procreation; medium has 1.0 to 1.5 such daughter, and high as more than 1.5 daughters. From UN Press Release

A person might think that growing population would be good for world economic growth rates, because rising population implies more workers and more demand. The problem is that all of these additional people will need to eat, and we will need to find food for them. If oil supplies become more constrained (discussed in a later section) this will put further pressure on food production because the Green Revolution was a heavy user of fossil fuels, including oil, for food production and transport. Perhaps human ingenuity will solve this problem, but no immediate solution appears to be on the horizon.

2. The development of an integrated world economy. After thousands of years on working on getting to an integrated world economy, we have finally pretty much reached the limit. This presents a two-part problem for world growth:

>> The “Kick” to world economic growth that we had in the past will no longer be there, because the synergies of integration have now pretty much been reached.

>> We are starting to see the down-side of an integrated world economy, such as downward pressure on wages, leading to demands for more separation. In future years, we may even see some “unwind” of an integrated world economy, resulting in less synergy.

Another concern with an integrated world economy is that with a single world economy, it is harder to deal with degraded ecosystems. As mentioned previously, Sing Chew writes about some societies collapsing due to ecosystem distress in one part of the world, while other societies continue, allowing the ecological systems in that area to rest. If all of the world’s economies are now integrated, the collapse of one economy leads to a much greater chance of collapse of other economies, especially if financial systems are connected.

In an integrated world economy, there is also the chance that the countries without problems will bail out countries with problems. This approach will temporarily prevent local collapses, but may eventually lead to the collapse of the world ecosystem, since it will prevent local ecosystems from resting when they need to.

3. The Development of Fossil Fuels (Coal, Oil and Natural Gas). On the upside of the growth curve, the addition of fossil fuels helped create economic growth. Now we are starting to hit limits, particularly with respect to oil. The limits we are reaching are of two types:

>> We can’t get oil out fast enough; and

>> What we can get out is so high-priced that its high price tends to cause recession, especially in countries that import large amounts of oil.

Sometimes the oil limits are described as peak oil. One way of describing the situation is that we are experiencing declining quality of oil resources. To some extent we are experiencing this problem with all fossil fuels, and with many kinds of metals, but the problem is most severe with oil.

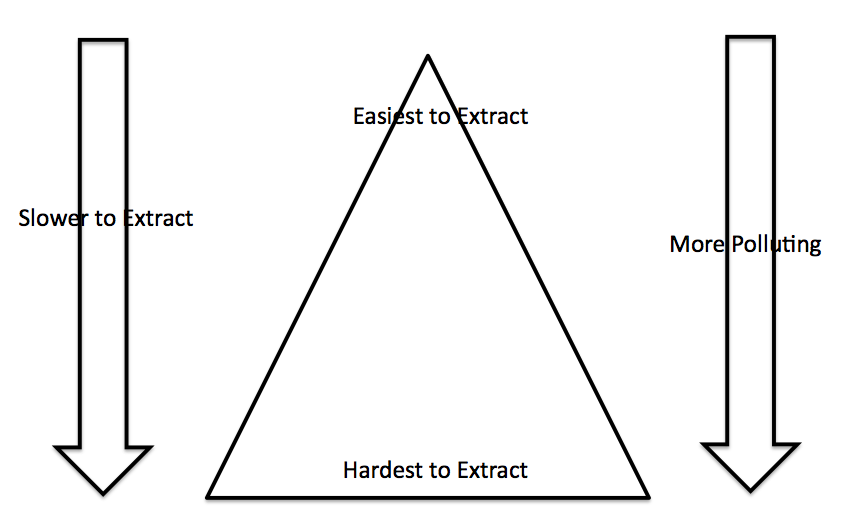

What happens is that when companies make a decision to extract oil or gas or any other kind of mineral, they choose the easiest to extract first. Such minerals tend to be inexpensive to extract.

After many years of extraction, what we have left is the lower quality, more expensive to extract resources. They may be deep underwater, or in countries with unstable political situations, or have serious pollution issues. On Figure 6, it is as if we start at the top of the triangle with the best-quality resources, and work our way down. It always looks as though there are plenty of resources; they are simply of lower and lower quality, so no “alarm bells” go off.

Figure 6. Author's illustration of impacts of declining resource quality.

But things aren’t really all right, because we can’t get the oil out fast enough to meet rising world demand, and prices go up, leading to recession.

The reason high oil prices tend to cause recession (which is declining economic growth) is because fuel for driving to work and food are necessities for most people. Oil is used to make gasoline, and to grow and transport food, so the prices of gasoline and food tend to rise when oil prices rise. If oil prices rise, consumers cut back on things they don’t have to have, like vacations and restaurant spending. This leads to layoffs affected industries, and possible recession.

Economist James Hamilton showed that 10 out of 11 recent recessions were associated with oil price spikes. The International Monetary Fund (IMF) evidently agrees that high oil prices are a threat to economic growth. A recent Wall Street Journal article talking about the IMF said,

High oil prices represent another major risk to the global economy. If tensions with oil-exporter Iran boil over and spur prolonged supply disruptions, it could force oil prices to surge above $165 a barrel, potentially causing another Great Depression, the fund said.

4. More Education. There is only a certain amount of education that makes sense for an economy, and the advanced economies are starting to reach these limits. A recent Wall Street Journal article called Education Slowdown Threatens US says throughout American history, almost every generation has had substantially more education than its parents, but this is no longer true. Individuals who turned 30 in 2010 had only 8 months more education on average than their parents according to a study by Harvard University economists Claudia Goldin and Lawrence Katz. If additional education was helping boost GDP growth in the past, it cannot be counted on for as much help in the future.

It might be noted that additional education is not necessarily helpful on very broad issues, such as “Should we expect the economy to grow forever?” One reason is that research tends to get very compartmentalized. Scholarly papers tend to be narrow in scope and very deep. Researchers are rarely good in economics and anthropology and geology and ecology at the same time. Therefore, their analyses tend to tackle only small pieces of the problem and miss the big picture.

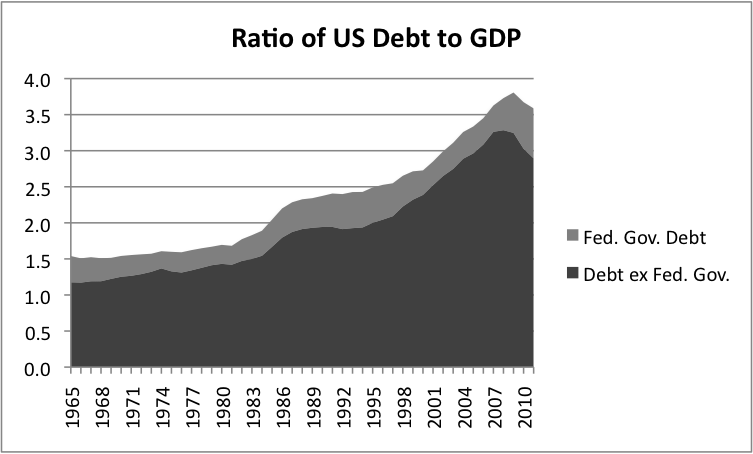

5. Aggressive Use of Debt Financing. Aggressive use of debt financing has limits, too, because after some point, people and businesses and governments can’t afford to pay back the debt, especially if interest needs to be paid as well. Figure 4, above, gave a hint that we are reaching limits, since amounts were no longer rising after 2008. If we look at the split between debt by the US Federal Government and other debt (Figure 7), we see that since 2008, government debt has rapidly escalated, while other debt has been dropping as a percentage of GDP.

Figure 7. Ratio of US debt to GDP, divided into the portion attributable to the US Federal Government, and the portion attributable to others (individuals, business, and local governments). Debt from Federal Reserve z1 report; GDP from US Bureau of Economic Analysis.

Some of the decline in non-government debt is related to debt defaults on homes with declining value; some of it is related to individuals defaulting on credit cards, and not being able to get new ones. Financial sector debt is also lower now. The Federal Government has ramped up its deficit spending since 2008, putting itself at risk of downgrade by rating agencies.

The absolute level of debt is very high now, raising questions as to whether this approach to ramping up demand is sustainable. Real people can’t pay back debt if their salaries are not high enough, or if the value of their homes is declining.

Other Stresses on the System

Besides the five items that helped on the way up that are a less helpful now, that we discussed in the last sections, there are some long-term problems that we always have to deal with. These include

1. Pollution. With more people and more industrial production in a fixed sized world, it is inevitable that there will be more pollution. This problem also arises because we are dealing with lower quality ores, and thus have more waste products to dispose of.

The Second Law of Thermodynamics says that the natural tendency is to move from an ordered state to a state disordered state. This means that all of the roads, buildings, and other things we build will tend to degrade over time, and we will have a constant battle with repairing whatever we build. If what we build is not repaired, it in time turns to pollution. The Second Law also implies that whenever we try to produce useful work (such as make electricity, or power a car, or pump water), there will always be waste heat produced.

One particular type of pollution of concern is carbon dioxide. Rising carbon dioxide levels can affect climate. They also cause ocean acidification. Rising carbon dioxide levels are of sufficient concern that work is being done to try to reduce consumption of fossil fuels. If fossil fuel use is reduced, it will be increasingly difficult to support rising world population with basic services (food, clean water, clothing, housing, and medicine).

2, Weather/Climate. Changing weather and climate conditions have always been a problem for human populations. In pre-historic times, this problem was solved by migration; hunter-gatherers simply moved to a different location, if weather was too severe. Now, the world is so full of people and so much infrastructure has been created for particular types of crops in particular locations that it is hard to make quick changes to match changes in weather conditions. High carbon dioxide levels raise concerns that weather changes may get worse.

3, Lack of fresh water. Fresh water is used in many ways, from cooling towers associated with electricity production, to irrigation, to industrial processes, to drinking and bathing. As world population grows and as economic activity increases, this puts more pressure on fresh water supplies. Changes in climate can also have an effect.

There are many potential “fixes” to shortages of fresh water, such as piping water from a distance (sometimes uphill), desalination, and treating wastewater so it can be used for drinking. All of these fixes require the use of energy in one form or another, and, as we have already seen, energy supplies are increasingly difficult to extract and often tied to carbon dioxide pollution. Also, if any of these fixes are tried, the price of water is raised. Since water is a necessity, this can lead to cutbacks in other expenditures, and thus recessionary influences.

Where do these observations put us now?

At the beginning of this post, we suggested that in order to provide goods and services, we needed four things:

1. Human Ingenuity

2. Materials

3. Energy Resources

4. A way to pay for the goods and services

The issues we have described show that 3. Energy Resources, particularly oil, is at risk. We have a large number of vehicles currently in operation that use gasoline or diesel for fuel, so this is a difficult issue to fix quickly. Inability to produce as much oil as we would like also puts us at risk for 2. Materials, because many materials depend on oil for their extraction and transportation.

The issues with too high debt level suggest that 4. A way to pay for goods and services may also be at risk. This leaves only 1. Human Ingenuity to solve our problems. While humans are very ingenious, we can’t expect their ingenuity to keep an economy growing indefinitely, with the other three all under stress.

Looking back at past history does not suggest simple fixes. Humans have had difficulty with sustainability since they were hunter-gatherers. “Renewables” have not proved to be very “scalable” in the past, suggesting that we may be expecting more than is reasonable of them now as well. Increased use of fossil fuels doesn’t appear to be a very good solution either, because of pollution issues. Scaling back the size of the economy is not easy either, because of the large number of additional people we expect to need to feed, and the fact that all of the infrastructure that is currently in place will tend to degrade, and therefore need repairs if it is to remain useful.

These issues will be discussed further in future posts.

Gail Tverberg has an M. S. from the University of Illinois, Chicago in Mathematics, and is a Fellow of the Casualty Actuarial Society and a Member of the American Academy of Actuaries. She is a long-time contributor to Energy Bulletin, The Oil Drum and other publications.

Gail Tverberg has an M. S. from the University of Illinois, Chicago in Mathematics, and is a Fellow of the Casualty Actuarial Society and a Member of the American Academy of Actuaries. She is a long-time contributor to Energy Bulletin, The Oil Drum and other publications.

Due to a recent spate of abusive, racist and xenophobic comments we are forced to revise our comment policy and has put all comments on moderation que.