BRICS Bank Established: Beginning of Financially Multi-Polar World

By Countercurrents

16 July, 2014

Countercurrents.org

BRICS Development Bank has been established on July 15, 2014 in the now-going BRICS summit in Brazil . It is an epoch-making event for the global south. A financially multi-polar world begins with the establishment of the much-hoped BRICS bank. It is the beginning of the end of US dollar-dominance and the dominance of the Bretton Woods institutions – the World Bank and the International Monetary Fund. Establishment of the bank surpasses all on-going incidents around the world.

The long-awaited bank is the first major achievement of the BRICS countries since they got together in 2009 to press for a bigger say in the global financial order created by Western powers after World War II.

Bringing emerging economies closer has become vital at a time when the world is guttered by the financial crisis and BRICS countries can't remain above international problems, said Brazil 's president Dilma Rousseff.

She cautioned the world not to see BRICS deals as a desire to dominate.

“We want justice and equal rights,” she said.

“The IMF should urgently revise distribution of voting rights to reflect the importance of emerging economies globall y,” Rousseff said.

BRICS, the group of emerging economies, signed the long-anticipated document to create the $100 bn BRICS Development Bank and a reserve currency pool worth over another $100 bn. Both will counter the influence of Western-based lending institutions and the dollar. Brazil , Russia , India , China and South Africa form the BRICS.

The new bank will provide money for infrastructure and development projects in BRICS countries, and unlike the IMF or World Bank, each nation has equal say, regardless of GDP size.

“BRICS Bank will be one of the major multilateral development finance institutions in this world,” Russian President Vladimir Putin said on July 15, 2014 at the 6th BRICS summit in Fortaleza , Brazil .

The launch of the BRICS bank is seen as a first step to break the dominance of the US dollar in global trade as well as dollar-backed institutions such as the IMF and the World Bank, both US-based institutions BRICS countries have little influence within.

“In terms of escalating international competition the task of activating the trade and investment cooperation between BRICS member states becomes important,” Putin said.

BRICS account for 11 percent of global capital investment, and trade turnover almost doubled in the last 5 years, the Russian president reminded.

Each BRICS member is expected to put an equal share into establishing the startup capital of $50 billion with a goal to reach $100 billion.

The BRICS bank will be headquartered in Shanghai , India will preside as president the first five years to be followed by Brazil and then Russia , and Russia will be the chairman of the representatives.

Each country will send either their finance minister or Central Bank chair to the bank's representative board.

Membership may not just be limited to just BRICS nations, either. Future members could include countries in other emerging markets blocs, such as Mexico , Indonesia , or Argentina , once it sorts out its debt burden.

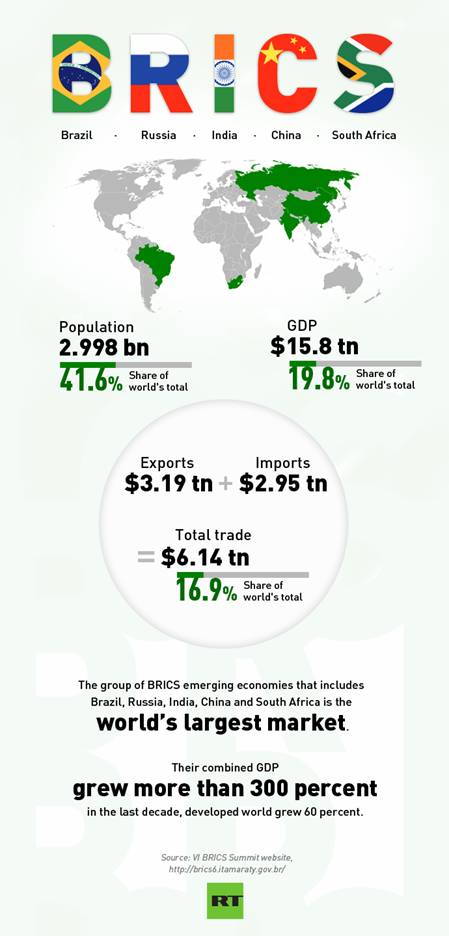

BRICS represents 42 percent of the world's population and roughly 20 percent of the world's economy based on GDP, and 30 percent of the world's GDP based on PPP, a more accurate reading of the real economy. Total trade between the countries is $6.14 trillion, or nearly 17 percent of the world's total.

The $100 billion crisis lending fund, called the Contingent Reserve Arrangement (CRA), was also established. China will contribute the lion's share, about $41 billion, Russia , Brazil and India will chip in $18 billion, and South Africa , the newest member of the economic bloc, will contribute $5 billion.

The idea is that the creation of the bank will lessen dependence on the West and create a more multi-polar world, at least financially.

The mechanism creates the foundation for an effective protection of the national economies from a crisis in financial markets.

BRICS has already created the BRICS Stock Alliance, an initiative to cross list derivatives to smooth the path for international investors interested in emerging markets.

Documents on cooperation between BRICS export credit agencies and an agreement of cooperation on innovation were also signed.

Russia has also proposed the countries come together under an energy alliance that will include a fuel reserve, as well as an institute for energy policy

A Reuters report headlined “BRICS set up bank to counter Western hold on global finances” said:

Leaders of the BRICS launched a development bank and a currency reserve pool in their first concrete step toward reshaping the Western-dominated international financial system.

The bank is aimed at funding infrastructure projects in developing nations.

The Fortaleza , Brazil , July 16, 2014 datelined report said:

The BRICS were prompted to seek coordinated action following an exodus of capital from emerging markets last year, triggered by the scaling back of US monetary stimulus. The new bank reflects the growing influence of the BRICS, which account for almost half the world's population and about one fifth of global economic output. The bank will start with a subscribed capital of $50 billion divided equally between its five founders, with an initial total of $10 billion in cash put in over seven years and $40 billion in guarantees.

The report by Alonso Soto and Anthony Boadle said:

The bank will start lending in 2016. The capital share of the BRICS cannot drop below 55 percent. The contingency currency pool will be held in the reserves of each BRICS country and can be shifted to another member to cushion balance of payments difficulties. This initiative gathered momentum after the reverse in the flows of cheap dollars that fueled a boom in emerging markets for a decade. "It will help contain the volatility faced by diverse economies as a result of the tapering of the United States ' policy of monetary expansion," President Dilma Rousseff said.

If a need arises, China will be eligible to ask for half of its contribution, South Africa for double and the remaining countries the amount they put in.

Is BRICS in decline?

A Xinhua news analysis on BRICS said:

Some politicians in the West claim that the five BRICS economies are fragile and fading, and are even in a decline.

The “Is BRICS really in decline?” headlined news analysis said:

Zhang Jun, an official from China 's Ministry of Foreign Affairs, said in early July that the Western opinion of a fading BRICS is biased. Observers say such claims are totally unfounded and are a serious misjudgment of world economic development.

The Beijing , July 13 datelined news analysis said:

Because of their crucial structural adjustment and changes in the international financial situation, especially the US tapering of quantitative easing measures, some BRICS countries have registered slowing economic growth and faced difficulties in their growth.

However, it would be short-sighted for West politicians to draw a conclusion that the BRICS miracle is over.

Huang Wei, a researcher from the Chinese Academy of Social Sciences, told Xinhua that the West has regrettably forgotten the fact that even with slowing growth, the BRICS economies still expand twice as fast as developed countries.

Some Western politicians are inclined to have a prejudiced opinion of developing countries, ignoring the positive side and hyping up the negative aspects, said Huang.

"Westerners with a biased view tend to magnify small problems of developing countries," said Huang, "For instance, they predicted a collapse of the BRICS cooperative mechanism when they saw some minor differences in their first round cooperation."

Cooperation within the framework of BRICS over recent years has proven an improving and cooperative, rather than deteriorating, mechanism among the BRICS countries.

Fan Yongming, director of a BRICS research center at Fudan University in Shanghai , said the Western politicians' unfavorable opinion of the BRICS prospects is but a serious misjudgment of BRICS and world economic development.

"Economic growth is always cyclical," he said, "This is true for developed countries as well as developing countries. The changes in BRICS economic growth has been normal."

"Actually, the BRICS countries have tided over the most difficult waters and are now turning for the better," he said.

It said:

Many experts have pointed out that one major reason for slowing BRICS growth is their active structural adjustment in order to achieve sustainable growth. This is fundamentally different from problems in developed economies such as liquidity crisis, debt crisis, and weak demand.

The anaemic growth of developed economies has also posed a significant challenge to exports of BRICS countries, they added.

On the future BRICS, the news analysis said:

Facts and figures show a bright future for the BRICS countries.

The five developing nations now account for 21 percent of global output and have contributed more than 50 percent of world economic growth in the past decade.

According to Fan, the developing BRICS countries have three major advantages in future development compared with developed economies: population, resources, and the market.

That means sufficient labor supply, abundant natural resources, and vast consumption potential, which have been the main pillars supporting BRICS' fast growth and will remain so in the future, he said.

Fan also stressed that the political stability of BRICS countries will guarantee a speedy recovery to fast growth for BRICS countries.

Besides, after years of development, the BRICS countries have seen improving and cooperative mechanism and also closer cooperation among them. That will become a vital driving force for their economic development, he added.

So far, the BRICS countries have set up a business council, a think tank council.

A BRICS development bank will contribute to a greater negotiating capacity of BRICS in the international financial system.

Brazilian Ambassador to China Valdemar Leao said, "The establishment of a BRICS development bank sends a clear message to the world that the five countries are ready and determined to make greater contribution to the sustainable growth of their own countries as well as the rest of the world."

The five BRICS countries account for 29.6 percent of world's territory, and 42.6 percent of world population. The five BRICS economies are highly complementary to one another in terms of trade, with vast potential for cooperation.

Li Jianmin, a researcher on Russia , Eastern Europe and Central Asia with the Chinese Academy of Social Sciences , said the BRICS countries may further promote economic growth if they can stimulate further trade and investment cooperation among themselves.

According to estimates by some international organizations, the economic growth rate of the BRICS countries this year will far outdo the global average and will be twice that of developed economies.

The international community generally believes that the BRICS countries are an important engine for global economic growth in a post-crisis world and are changing the map of wealth creation.

The BRICS countries still have a sound fundamental aspect of their economies, possess sufficient macroeconomic policy tools and enjoy great potential for future growth, observers say.

A defeat for the US

The World Trade Organization agreed on July 14, 2014 to side with claims against the United States made by both China and India concerning US-imposed tariffs on products exported to America .

In both instances, the WTO ruled against the US and decided in favor of the major BRICS countries, who for two years now have each asked the organization to intervene and weigh in on America 's use of tariffs to tax certain imports dating back to 2007.

With regards to both cases, the WTO's judges ruled that the US acted “inconsistent with its agreement on subsidies and countervailing duties,” or taxes imposed on goods sold by “public bodies.”

In China , the panel agreed, US officials improperly levied those taxes against state-owned enterprises that the WTO does not consider to be “public bodies.” Instead, the WTO said, those entities were majority-owned by the Chinese government, but did not perform “government function” or exercise “government authority,” according to the Financial Times.

With respect to India , the WTO again agreed that the US was wrong to similarly treat state-owned National Mineral Development Corporation as a public body, according to the International Business Times.

At issue were billions of dollars' worth of Chinese steel products, solar panels, aluminum, paper and other goods shipped to the US after being taxed as originating from public bodies.

The panel's decision “reflected a widespread concern in the 160-member WTO over what many see as illegal U.S. protection of its own producers.”

“ China urges the United States to respect the WTO rulings and correct its wrongdoings of abusively using trade remedy measures, and to ensure an environment of fair competition for Chinese enterprises,” China 's commerce ministry said in a statement.

Mike Froman, the US trade representative, responded by saying Washington was “carefully evaluating its options, and will take all appropriate steps to ensure that US remedies against unfair subsidies remain strong and effective”.

Nevertheless, Froman added that the WTO's ruling in the Indian case constituted at least a partial victory for the US .

"The panel's findings rejecting most of India 's numerous challenges to our laws and determinations is a significant victory for the United States and for the ( US ) workers and businesses making these steep products," he told Reuters.

Comments are moderated