India: What Lies Behind The Doubling Of Gas Prices?

By Rahul Varman

19 July, 2013

Sanhati.com

The cabinet decided to double the natural gas prices from $4.2 to $8.4 per million British thermal unit in an unprecedented decision last week; the price increase will be effective from the next financial year beginning April 1, 2014. Since the hike is in dollars and rupee is currently running at a historic low, the actual raise in rupee terms is more than two and a half times. It is quite shocking for a government to make this kind of a drastic hike in an election year, that too for a commodity that is a basic input as a household fuel, for power production, as well as fertiliser. Consequently it will have an all round adverse effect on the common people who are in any case in dire straits given the unparalleled inflation in recent years.

Amidst sustained pressure from the country’s key private and the largest gas producer, the Reliance-British Petroleum combine, in December 2012 one more of the many official committees on gas pricing, this time headed by C. Rangarajan, Chairman of the Prime Minister’s Economic Advisory Council, recommended that India should shift to a single gas pricing formula for all forms of gas and all consuming sectors with domestic gas prices being determined on an ‘arm’s length’ basis. Their proposed ‘market friendly’ formula takes the average of the price of imported gas across sectors over a 12-month period and that of prices in the three major international gas trading hubs — US Henry Hub, UK National Balancing Point and Japan’s custom-cleared rate — to arrive at the final price for gas in India. Apparently the present price hike is based on this formula.

The government and the industry bodies have come up with several reasons for the massive price hike:

* First and foremost, it will bring FDI and technology. As FICCI said,

The revision in natural gas price will bring in the much required technology and risk capital from foreign majors to tap vast unexplored resources in the deep and ultra-deep water frontier basins (NDTV Profit, June 28, 2013 [1]).

* It will reduce the steep energy import bill as it will incentivise the domestic producers.

* It will improve power generation as well as fertiliser production and support efforts to revive India’s flagging gross domestic product growth which sank to a decade’s low of 5% this year.

* Increase in gas prices would result in additional royalties and profits for the government and public sector producers, like ONGC and Oil India.

Predictably Sensex soared by 520 points within a day of the price announcement and shares of energy companies surged. Apparently, the FIIs, who were on a selling spree all through the month of June, reversed the trend, and rupee, which was on an unprecedented downward spiral, also saw a temporary reprieve though the trends could not be sustained by the time of writing of these lines in early July. Let us have a closer look at the assertions above and try to go beyond what is apparently being claimed to understand the political economy of the price hike.

The International Gas Prices

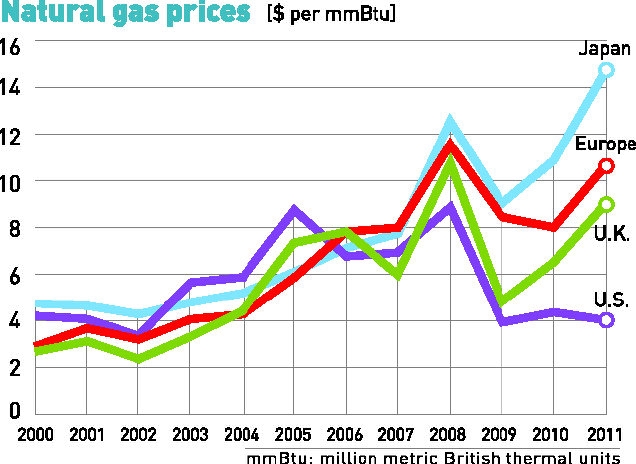

The primary reason why Reliance and the industry have been seeking higher prices now for more than a year, it seems, is the high international price of $14 per unit. Gas utilisation in India has risen faster than domestic production and availability, resulting in imports of liquefied natural gas (LNG) that is regassified in domestic facilities for local use. But if we look closely at the international prices, we realise that international gas market is highly fragmented and prices depend upon the fast changing demand-supply situation in various local markets, that is why current prices range from $4 in the US to almost $15 in Japan (see the graph below). Ostensibly this is the reason why Rangarajan committee recommended an average of prices at three different locations to arrive at the ‘arm length’ price. But the problem is that Japan has little relevance for Indian prices as most of India’s imported gas is being brought from countries like Qatar where the current price is around $2.5 [2]; this is even truer for the domestic gas price as Japan produces very minimal gas of its own. Moreover even $14 price is for the LNG and mixing up LNG price with that of natural gas is highly problematic as the former includes many added costs, like liquefaction, transportation, taxes, etc. Furthermore the Rangarajan recommendations are mixing up the wellhead price of natural gas and the price of LNG as Surya Sethi [3], former Principal Adviser, Power & Energy, Government of India, has been at pains in repeatedly emphasising. Even more starkly, given the new sources like shale gas in some of the largest producing nations like US and China, the international gas prices are facing downward pressure at the time when India has decided to double the prices.

Source: Frontline, July 12, 2013 [4]

Impact on the Fiscal Position of the Government

Several statements by the government and industry bodies have alluded that the price hike will mean more royalties for the government and primary beneficiary are going to be the state owned gas producers. But this is a banal exercise in distorting facts and obfuscating issues. The gas is primarily being used as a key input for gas based electricity generation and feedstock for fertiliser production – a large number of these units are PSUs. For both power and fertiliser, the final price to the consumer is controlled by the government as it involves essential commodities like electricity and food, that too in a country where the wages of the masses are far from indexed. So there is consensus amongst observers that it will only increase the fiscal woes of the government and further cost them several thousand crores in ‘subsidies’ even if it may lead to some profits to oil producing PSUs. According to one estimate [5], the annual outflow in terms of subsidies to the fertiliser sector will be Rs 17,000 crores and increased cost of fuel for the power sector Rs 43,000 crores. The distribution companies in the power sector are currently in the red by Rs. 2 lakh crores, a position which will even further worsen with this hike in prices. About 10% of India’s electricity generation capacity is based on natural gas and these plants will become inoperable given the step hike in the gas prices and the government will have no option but to foot the huge subsidy bill.

The Ultimate Beneficiary

Finally there is only one way to interpret the price hike: that there is going to be one ultimate beneficiary of the steep raise given the present arrangement and that was also the primary motive force in persisting with the demand for the so called ‘international market price’. The windfall for the Reliance-BP combine is going to be massive though it is hard to quantify the amount at this point for complex reasons. We need to go back a little in time to 2003-04, when the company announced its first commercial discovery of massive gas finds in the Krishna Godavari (KG) Basin, in order to appreciate the implications of the price hike and its relations with the Reliance corporation (for details see an earlier analysis, published in Sanhati). At that time Reliance was willing to supply gas to NTPC at $2.34 for 17 years, a commitment that it backed out from when an EGoM headed by Pranab Mukherjee raised the price to $4.2, and the matter is still subjudice in Mumbai High Court. Now if Reliance could make profits at $2.34 (it is hard to digest that they were willing to supply gas to NTPC at a loss!), how come it cannot make any at $4.2 that it needs to be further doubled?

There are further interesting issues involved in the Reliance gas business, as elaborated in the earlier analysis [6], which are relevant to put the present price hike in perspective. With the increase in price to $4.2 in 2007 Reliance was supposed to pay a much higher share of profits to the government as per the production sharing contract (PSC). Interestingly Reliance increased its investment by three times while claiming to have doubled the production capacity belying ‘economies of scale’. As per the PSC the significant share of profits start accruing to the government only after the private operator has covered its share of investment through revenues earned to the tune of 2.5 times the investments. Thus while Reliance gold plated the investments and skimmed off the earnings with minimal sharing with the government, now it has gained almost quadrupling of the gas price from its original when the initial investments were made with the promise of huge discoveries. While the production in 2012-13 was supposed to have come to the full capacity of 80 mmscmd it has precipitously declined to 15 mmscmd, most likely in the quest for this high price which is going to be implemented from 1st April next year. Meanwhile, Reliance has offloaded 30% stake of its gas business to British Petroleum in 2011 in spite of lack of production and according to Reliance even lack of incentive for international operators. It is interesting how Reliance-BP combine is being incentivised for their lack of performance. Can we imagine the storm if this was being done by a PSU!

While the NTPC-Reliance dispute continues, in 2011 the CAG came up with a stinging report on the noncompliance of various provisions of the PSC by both the MoPNG as well as Reliance – retention of more than 7000 square kilometres of the basin area where Reliance had not made any discovery and which should have gone back to the government and they should have been allowed to retain only 350 square km basin, the front ending of the capital investments to avoid sharing of profits with the government, and the ongoing dispute where the contractor has refused to cooperate with the CAG for a proper audit of the public expenditure as per PSC, that too for precious energy resource like gas which ultimately belongs to the people of the country. The CAG submitted a detailed report in 2011 on the acts of omission and commission of both the Petroleum Ministry and Reliance on which the government has yet to take any action. Thus while CAG has to wait, NTPC has to delay its vital investment plans, the only entity whose exhortations have to be fast tracked so much so that the price hike has to be announced nine months in advance is the Reliance-BP combine!

The Real Reason behind the Price Rise

Given the timing, the massive hike and the beneficiaries on one side and the losses that are going to be borne both by the government as well as common people, there is only one way to interpret the outcome: that special corporate interests hold complete sway over policy making. If the purpose is to attract foreign investments, why should the domestic producers, that too the existing ones, who have already been incentivised as per the PSC, need to be part of this price hike? In any case if price hike from $2.34 to 4.2 did not lead to investments why will this new hike lead to the desired outcome? Moreover, even before this hike BP has made a $7 billion investment and bought 30% stake in the Reliance KG basin. But at present there is no way to reason with the government or hold the special interest groups accountable for their blatant profiteering and its facilitation by the state.

The real reason is that in the times of neoliberalism and monopoly capital, the corporate agents and their apologists like the present state, will keep seeking the highest possible price for their produce and the lowest possible price for their inputs like labour and the whole system including the state and media are geared towards this logic – the people, natural resources and/ or long term public interests ought to be made subservient to this overarching reality. This is the only way we can explain this absurd decision and be rest assured that this is not the end of the story. In fact after the corporate interests were assured of the present hike, BP was already demanding “a $1.5 per mmBtu additional ‘incentive’ for deep-sea fields over and above the near doubling of domestic gas price suggested by the Rangarajan Committee” in April to the ever indulgent Prime Minister (The Hindu, Apr. 29, 2013 [7]). In an earlier article a few months back this author had anticipated that magically the gas production from KG D6 will increase once the price that Reliance wants is awarded to them and we already have some indications towards this. It may not be a coincidence that last month, anticipating the price hike, Niko, the Canadian third partner in the KG basin gas increased its estimates of gas reserves by 1.6 times [8], while the petroleum minister generously decided that Reliance can continue keeping the bulk of KG basin area overruling the Director General of Hydrocarbons (DGH) who had ordered the contractor to relinquish 86% of it as per the provisions of PSC9. Even further, there is now demand from power and fertiliser interests to ‘free’ them from government controls meaning similar jumps in prices in the two sectors. This is the direction in which the present state-corporate interests are going to move until-unless there is tremendous resistance and upsurge against these policies, like what we are witnessing in Brazil, Turkey and other parts of the globe.

References

1 Gas price hike to incentivise investment in sector: India Inc., accessed on July 06, 2013.

2 Lola Nayar, All heads in the oven. Outlook India, accessed on July07, 2013.

3 Surya Sethi, Of Reliance, by Reliance, for Reliance. The Hindu, July 01, 2013.

4 C P Chandrashekhar, Cost of Reliance on Gas. Frontline, July, 12, 2013.

5 Prabir Purkayastha, Whether Gas Pricing or Spectrum, Ambanis Rule. Newsclick, June 1, 2013, , accessed on July 06, 2013.

6 Rahul Varman, Cowboy Capitalism: The Curious Case of Reliance KG Basin Gas Business, Sanhati.

7 BP seeks $1.5 bn incentive for deep-sea gas. The Hindu, April 29, 2013.

8 Reliance Industries gains on reserves hopes. The Economic Times, , accessed on July 07, 2013.

9 Moily hints of relief to RIL on KG-D6 relinquishment. The Financial Express, accessed on July 07, 2013.

Rahul Varman ( [email protected] ) is on the faculty of Indian Institute of Technology, Kanpur, India, where he teaches and writes about corporations and the working class in the neoliberal order, and participates in the struggles of contract workers.

Comments are moderated