Peak Oil - Now or Later? A Response To Daniel Yergin

By Euan Mearns

21 September, 2011

The Oil Drum

In a recent article called There Will Be Oil in the WSJ, Daniel Yergin once again attempts to debunk the concept of peak oil and sees global production capacity growing to 110 mmbpd by 2030, followed by slow decline. In this short report I will take a quick look at his key arguments in an effort to bring further convergence between the peak oil and business-as-usual camps.

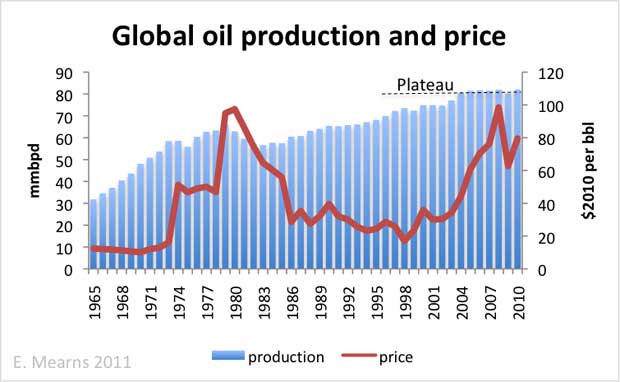

Global oil production (crude + condensate + natural gas liquids: C+C+NGL) has been on an 82 million barrel per day plateau for 7 years despite record high oil price, deployment of technology such as horizontal wells and 3D seismic, the development of new oil provinces such as offshore Angola and unconventional play concepts such as the Bakken shale in North Dakota. Oil production rose during the great oil bear market from 1980 to 1998 but has largely stagnated during the great bull run ever since. Many things are upside down on the back side of Hubbert's peak. Data from BP.

Decline rates

Any discussion about peak oil should begin with decline rates. Yergin’s organisation CERA is well aware of this fact having produced an excellent report on the subject a few years ago.

Decline is the natural process whereby production rates fall as a result of depressurisation of the reservoir combined with water ingress into the oil-bearing strata. Oil production companies go to great lengths to mitigate for decline by injecting water or gas to maintain pressure, well maintenance programs (work overs) and by drilling new wells. Observed declines are therefore much less than natural declines but nevertheless run at a globalised average of around 5% per annum.

With global C+C+NGL production running at 82 mmbpd, 5% observed net declines will wipe out 4.1 mmbpd capacity every year. What this means is that the oil industry must add 4.1 mmbpd new capacity every year from new field developments just to stand still. And this new capacity has to be derived from a stock of second-tier assets such as deep water Gulf of Mexico, heavy sour oil in Saudi Arabia, Arctic oil or the Bakken Shale since most of the favoured tier-one assets have already been produced.

In order for production to grow beyond the 82 mmbpd plateau the oil industry must add more than 4.1 mmbpd new capacity every year from an ever degrading pool of resources. To reach 110 mmbpd in 2030 would mean adding more than 4.1 mmbpd each year to 2030 reaching an additional 5.5 mmbpd new capacity in that year. Where is this new capacity going to come from? Yergin cites a list of new discoveries and new play concepts. But it has always been the case that new discoveries and plays have been developed and produced, and for the past 7 years these have been inadequate to provide new production in excess of declines.

New plays and play concepts

The oil industry continues to make new discoveries and to deploy new technology that has made it possible to develop low-quality reservoirs that would have been un-commercial a decade ago without new technology and high price. The giant Claire Field off the west coast of Scotland, and the Haradh segment of S Ghawar and the Khurais field, both in Saudi Arabia, are examples of low quality reservoirs, discovered decades ago, whose commercial development has been made possible by extended reach horizontal wells. Developing these giant fields in this way has enabled the global industry to maintain the 82 mmbpd plateau but not to exceed it.

Yergin cites new discoveries off shore in Ghana, Brazil and French Guiana as examples of new plays that may boost future production together with unconventional oil from Canadian tar sands and oil produced from shales like the Bakken. New production in Angola, Rajasthan in India, Congo Brazaville, and deep water GOM may be added to the list of recent new provinces that have been brought on stream. The fact is that without this steady stream of new developments, the oil industry will fail to maintain production at current levels and production will enter the decline phase.

UK independent explorer Cairn Energy has just drilled 6 dry wells in the Arctic waters off the West coast of Greenland, reminding all that despite the best seismic technology and basin models, exploration remains a high risk business.

The Bakken Shale in North Dakota does represent an interesting case study.

In 2003, the Bakken formation in North Dakota was producing a mere 10,000 barrels a day. Today, it is over 400,000 barrels, and North Dakota has become the fourth-largest oil-producing state in the country. Such "tight" oil could add as much as two million barrels a day to U.S. oil production after 2020—something that would not have been in any forecast five years ago.

In email correspondence, Oil Drum editor Arthur Berman pointed out that Bakken production comes from around 6000 wells, giving an average rate of about 67 bpd per well whilst Oil Drum editor Tad Patzec pointed out that in the GOM total, Bakken production may come from a handful of Macondo-type wells. Thus, while there is an interesting lesson for all to learn from the Bakken, the scale of effort required to win this production is immense and despite this effort, global oil production remains glued to its 82 mmbpd plateau.

Similarly, the immense effort to develop the Canadian tar sands has not managed to boost global production for the last 7 years. If this scale of effort made in the tar sands and the Bakken are not maintained then global oil production will fall.

Oil price and technology

Hubbert insisted that price didn't matter. Economics—the forces of supply and demand—were, he maintained, irrelevant to the finite physical cache of oil in the earth. But why would price—with all the messages that it sends to people about allocating resources and developing new technologies—apply in so many other realms but not in oil and gas production? Activity goes up when prices go up; activity goes down when prices go down. Higher prices stimulate innovation and encourage people to figure out ingenious new ways to increase supply.

I certainly agree with Yergin that the simplistic geological maximum flow rate model advocated by early workers such as Hubbert needs to be refined to incorporate a systems approach based on economics, society, politics and technology. It is of course the case that high price will stimulate oil industry activity whilst at the same time reducing demand. The key question here is where does the price balance lie between stimulating production and killing demand?

Yergin fails to mention that we have experienced a high price environment for several years now and this has failed to boost production beyond the 82 mmbpd plateau (see chart up top), in part because high price has at the same time tempered demand for oil, especially in the OECD. High price does not seem to have impacted the decline of the North Sea at all, although it seems likely that without high price that decline would have been even more rapid. Ingenious technologies have helped maintain this plateau but it is far from clear that they will in future move oil production substantially above it.

5 trillion barrels more

Currently, it is thought that there are at least five trillion barrels of petroleum resources in the ground, of which 1.4 trillion are deemed technically and economically accessible enough to count as reserves (proved and probable).

There is simply no point speculating about vast unconventional oil resources replacing the easy flows of light sweet crude upon which our current society and economy is based. The cost of recovery, in economic, energy and environmental terms is quite simply too high. And as already noted for unconventional oil sources like the Bakken and Canadian tar sands the scale of endeavour required is immense compared with traditional oil that flows out of the ground at rates of tens of thousands of barrels per day. The type of society that may be founded on unconventional sources such as these will look very different to today's society that is founded on easy flows of cheap oil.

A parable on Scottish unconventional diamond resources may help illustrate this point. Diamonds occur in Earth’s upper mantle, at depths greater than 100 kms, below crust of Archaean age (older than 2.5 billion years old). Scotland is blessed to have rocks of this age in the northwest highlands of our small country providing us with potentially millions of tonnes of diamond resources. All we need to do is to wait for prices to rise and the right technology to come along that will enable us to mine at such great depths and we will single handedly flood the market (dumping prices – oops) ending diamond scarcity once and for all.

Peak demand

In this view, the world has decades of further growth in production before flattening out into a plateau—perhaps sometime around midcentury—at which time a more gradual decline will begin. And that decline may well come not from a scarcity of resources but from greater efficiency, which will slacken global demand.

The concept of peak demand is actually one that I subscribe to but certainly not in the way articulated here by Yergin, who seems to believe that improved energy efficiency will lead to a reduction in demand for oil. In fact, the exact opposite of this is more likely to be true where improved energy efficiency enables society to afford a higher price that will lead directly to more, not less oil being produced.

The notion of peak demand that I subscribe to is one where there is a maximum price for oil that the global economy / society can bear. That price will fix the amount of poor quality resources that can be converted to reserves since every time the price ceiling is hit the World gets cast into recession reducing demand for oil in a way just experienced during the 2008 / 09 peak oil crash.

Summary and conclusions...

Over the years there has been significant convergence between the peak oil and business-as-usual camps, each hopefully learning from the other. Yergin, whilst attempting to debunk peak oil, appears to have been converted to a late peakist. I can certainly relate to many of the concepts described by Yergin - price influencing supply and demand, technology, innovation and new plays etc - but wonder when these are going to result in new production capacity (supply) that exceeds annual declines?

The stakes are high. Should policy makers listen to Pulitzer Prize winning historians? Or should they listen to geologists and a growing band of economists who can see the dependency of economic growth upon increasing supplies of cheap energy that quite simply do not appear to exist? Most important of all, will the WSJ publish a modified view of the oil world than that presented by Daniel Yergin?

Euan Mearns has BSc and PhD degrees in geology from the University of Aberdeen. Following 8 years in Norway as a researcher at the University of Oslo, he returned to Aberdeen in 1991 where he set up a geochemical analysis and consulting firm serving the international oil industry. For the last year he has been writing technical articles for The Oil Drum Europe.

This work is licensed under a Creative Commons Attribution-Share Alike 3.0 United States License.

Comments are not moderated. Please be responsible and civil in your postings and stay within the topic discussed in the article too. If you find inappropriate comments, just Flag (Report) them and they will move into moderation que.