Shifts

And Faultlines In The World Economy And Great Power Rivalry: What

Is Happening

And What It Might Mean

PART 2. CHINA’S CAPITALIST DEVELOPMENT AND CHINA’S RISE IN THE WORLD IMPERIALIST SYSTEM: ITS NATURE AND IMPLICATIONS

By Raymond Lotta

05 August,

2008

Countercurrents.org

This is the second in a series of articles about major transformations taking place in the world imperialist system.

Part 1 of this series discussed how the balance of international economic power is shifting among the major imperialist powers and how new geoeconomic blocs of countries are taking shape. The potential is growing for various powers, or alliances of powers, to gain greater geopolitical capacity to challenge U.S. dominance—not necessarily through direct confrontation in this period but nonetheless in increasingly strategic ways. These developments are interacting with other contradictions, conflicts, and struggles in the world.

The U.S. still occupies the primary position in the imperialist world economy. It is the largest economy; the financial glue of the whole world system; and the political-military “guarantor” of a global order that benefits, at least for now, all the big powers.

The U.S.’s economic position in the world has been declining. But U.S. imperialism possesses unparalleled military strength relative to rivals and would-be rivals. And since 2001, it has been pressing this advantage—mounting a global military offensive, focused in Iraq and Afghanistan, to secure unchallengeable dominance for decades to come.

But the United States is encountering difficulties in pursuing its global agenda. Its financial system has been experiencing growing turmoil. The shifts and changes in world economics are impacting U.S. imperialism’s freedom of maneuver.

In short, the imperialist system is in flux. And China is a highly dynamic element in the equation.

The nature of China’s development, and the implications of China’s rise in the world imperialist system, is the topic of this article.

I. INTRODUCTION: NOT A SOCIALIST SOCIETY, A COMPLEX DYNAMIC OF DEVELOPMENT

Many people assume that China is a socialist society—after all, its leaders describe their system as socialist and there is, in name, a ruling communist party. But socialism no longer exists in China. It was overthrown in October 1976. Deng Xiaoping and other leading neo-capitalist forces within the Chinese Communist Party carried out a military coup soon after Mao Tsetung died. These forces moved quickly to arrest the Maoist leadership core and to suppress revolutionary opposition.

A new capitalist class rules China. It is subordinate to and dominated

by imperialism. Indeed, imperialism has deeply penetrated Chinese

society and economy: through investments by transnational corporations…through

the activities of global finance…through the influence of imperialist-controlled

institutions like the World Bank and World Trade Organization…and

through channels of culture and ideology.

China is dependent on imperialism: on massive inflows of investment capital into the Chinese economy; and on access to the export markets of the advanced capitalist countries, like the U.S., Japan, and Germany. This is what has been and what is now most determining of China’s capitalist development.

At the same time, precisely because China has been such a profitable arena for imperialist investment—based on its vast supply of super-exploitable labor, which is China’s “competitive advantage” in the world system—China’s economy has been growing rapidly. As this has continued, and as China’s rulers have acted to strengthen their base of power and initiative, China has gained increasing influence and leverage. This is occurring in a framework in which imperialism, particularly U.S. imperialism, dominates China.

China’s rulers are, increasingly, seeking to carve out space and pursue their own geostrategic interests within this framework and on the same underlying basis: the savage exploitation of wage labor. But in pursuing their interests, China’s capitalist rulers are presenting challenges to a framework that has largely benefited U.S. imperialism.

China may in fact be in transition to becoming an imperialist power. But whether it does, or does not, will not just be a function of economic factors, and certainly not simply those internal to China. Rather, this will turn on different and interpenetrating economic, political, and military developments in the world system, including unexpected developments: crises, wars, class struggles in China and the world, and revolutions.

Overall, a complex dynamic of dependency and growing strength is shaping China’s development and rise in the world imperialist system—and reacting back on this system. How this plays out is not predetermined. But it is already a major and defining faultline in the world.

II. CHINA’S RAPID GROWTH: DRIVEN BY FOREIGN CAPITAL, EXPORT-DEPENDENT

China is now the world’s second-largest economy after the United States. China’s rate of growth has been the fastest among all major economies in the world, averaging close to 10 percent growth in Gross Domestic Product (GDP) over the last two decades. By contrast the imperialist countries’ average annual growth rate was 2-4 percent. China’s GDP, its output of goods and services, doubled between 1990 and 2005. China, however, remains a poor country, with output (and income) per person far below that of the advanced capitalist countries.

China’s exceptionally high and sustained rate of growth and industrialization over the last two decades may well be without precedent in the history of capitalism. More to the point, this sustained growth is a) leading to an enormous buildup of productive capacity in China; b) profoundly influencing the trajectory of global capitalist development; and c) contributing to China’s rapid rise as a world economic power.

A. China in the World Economy

China is becoming the center of gravity of world manufacturing. In recent years, China has been among the top five major destinations for foreign investment, and it is the main destination for foreign industrial investment in the world. China has been a growth engine for the imperialist world economy. China consumes some 20 to 25 percent of the global supply of iron, steel, aluminum, and copper. China accounts for one-third of the world’s rise in demand for oil.[1]

China is deeply involved in the world economy. It is the world’s largest non-U.S. holder of dollars. It is engaged in competitive struggles for raw materials and energy resources in Africa and elsewhere with the U.S. (and other imperialist powers). China is emerging as a growing and increasingly assertive geoeconomic force in the world. And U.S. imperialism, for its part, has been increasingly targeting China as a potential long-term competitor and adversary.

China’s rapid growth is inextricably bound up with huge inflows of foreign investment capital:

- Foreign capital controls the majority of assets of 21 of China’s 28 leading industrial sectors.[2]

- By the early 2000s, transnational corporations, like General Electric,

accounted for over one-third of China’s industrial output.[3]

- Enterprises in which foreign capital is invested account for almost

60 percent of China’s imports and exports.[4]

Investment by foreign capital in China has spawned the development

of vast new production complexes in China’s coastal areas, where

80 percent of all foreign investment goes. And in the last twenty

years, some 200 million rural laborers have relocated to the urban

areas to find work.[5] This super-exploitable army of migrant labor,

facing low pay in work and discrimination in housing and services,

feeds the labor requirements of these production complexes.

Foreign capital in China is heavily invested in low-cost, low-value manufactured goods, like garments. China is also producing electronics and information technology (IT) goods—and is now the biggest exporter to the U.S. of computers, computer electronics, and other IT goods. But a high proportion of those exports involve assembly in foreign-owned plants in China or operations contracted to local Chinese capitalists of high-tech components manufactured outside of China.[6] This is an example of China’s distorted development.

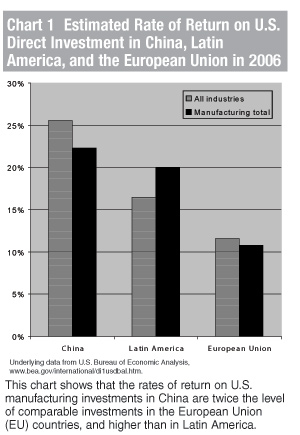

China is the largest recipient of direct foreign investment in the Third World. And overseas firms derive exceptionally high profits from their operations in China. As Chart 1 shows, rates of return on U.S. manufacturing investments in China are twice the level of comparable investments in the European Union (EU) countries, and higher than in Latin America.

Another example of imperialist-led development: when imperialist capital contracts out to Chinese firms, the flow of profits is disproportionately towards imperialism. Take an iPod sold in the United States for $299. Only $4 stays in China with the firms that assemble the devices, while $160 goes to American companies that design, transport, and retail the iPods.[7]

International capital has molded China’s economy into, and integrated it as, a key link in an East Asian regional system of high-profit, export-oriented production.

China relies heavily on the U.S. market, which is its top export destination. Thus China’s economic vitality hinges crucially on growth of demand in the U.S. market, demand that is increasingly financed by debt. China is also dependent on export markets in another way: it must exponentially expand exports to pay for its rising bill for imports of energy, minerals, food, semifinished goods, capital goods (like machinery), and luxury goods catering to its new affluent classes.

B. Some Historical Perspective and the Crimes of China’s New Capitalist Rulers

In the 19th century, Western capitalism came to dominate China—through wars, the imposition of unequal treaties, and the splicing up of China into foreign spheres of influence. The economic and military penetration by foreign powers brutally continued: the U.S.’s economic pressure to “open up” the Chinese market, Japanese aggression and occupation in the 1930s, and U.S backing of the corrupt and reactionary Chiang Kai-shek forces in China’s civil war of 1945-49. China had lost its sovereignty, and economic development in China was twisted and stunted by imperialist domination.

The Chinese revolution of 1949-76 changed all of this. It broke the vise-grip of foreign control. It destroyed the foundations of exploitative and corrupt landlord and bureaucrat-capitalist rule. China’s resources now served the needs of all-around development. Under Mao’s leadership, China constructed a self-reliant and balanced economy. A modern industrial base was built. Transport and power stations, part of a new infrastructure created by the collective efforts of society, served this balanced development. Industry was spread to towns and villages. Communes were established in the countryside: farming was carried out cooperatively at different levels, peasants joined together to construct vast irrigation and flood control systems, health services and education were provided at low cost. A skilled and healthy labor force was the result.

After overthrowing socialism in 1976, China’s new capitalist rulers basically opened China up and delivered it over to foreign capital. Imperialism, together with the new capitalist rulers in China, plugged into and transformed China’s past socialist development to serve the accumulation of capital. The new regime stripped workers of rights and turned them into wage slaves for foreign and new domestic capital. They dismantled the communes; and peasants dispossessed of land or unable to support themselves in agriculture migrated out of desperation (and the lure of higher incomes) to the cities in the booming coastal regions to become a caste of flexible, super-exploitable, and disposable workers. The infrastructure built up during the socialist period functioned as a kind of subsidy for imperialist-led development.

C. China’s Bourgeoisie and the State Sector

A state-based section of the ruling class is at the core of power in China and rules through its political instrumentality, the Chinese Communist Party—which has nothing in common with socialism or communism. This core fraction of the Chinese bourgeoisie has control over key levers of the Chinese economy. It regulates monetary and tax policy. It is closely linked to and dependent on foreign capital, and it is integrated with large domestic private capital. And it commands the military and repressive force of state power—and uses this power brutally against the masses, as we saw in the suppression of students and workers during the Tiananmen Square upheaval of 1989.

The state economic sector includes government-owned industrial enterprises and banks, and accounts for about 35 percent of China’s economy. The private capitalist sector of the economy is growing much more rapidly—and much of the state sector has been privatized. Since 1995, China’s state sector has undergone considerable restructuring. It has shed a vast number of firms and tens of millions of employees. But a core of state enterprises dominates much of heavy industry and key service sectors.[8] And the state sector remains an economic base of power of this leading fraction of China’s bourgeoisie.

State control remains very strong in the banking and insurance sectors, even as they have sold shares to private international investors.

Within the framework of imperialist domination and dependency on imported technology, the Chinese state has, to some degree, been strategically steering China’s development. One of its goals is for China to “move up” the manufacturing ladder to more sophisticated production. China is producing more capital-intensive goods, engaging in more modular (technologically advanced, standardized) manufacturing, and so forth.

China’s ruling class is attempting to expand and diversify China’s industrial-technological base and to influence patterns of development.

An auto industry, spearheaded by foreign capital (companies like Volkswagen and General Motors), is now rapidly developing in China. But as a condition of entry into the China market, the Chinese government is requiring unprecedented technology transfers from transnational corporations. The regime has insisted that its domestic automotive makers maintain joint ventures with its competing foreign partners.

Very importantly, China is investing in large-scale and long-term research and development. And the government is promoting national private and state companies to be national frontrunners in industries like computers and telecommunications.

China’s rulers are seeking to turn imperialist, foreign-dominated development into a base to fortify China’s position as a world economic power and from which to project and amplify that power on a world scale.

Still, China’s high-speed development as it has unfolded remains dominated by foreign capital and reliant on international markets. It is vulnerable to fluctuations in world market demand. It must attract foreign capital—which is constantly looking for even more low-cost zones of production—from Mexico…to China…to Vietnam. This project requires and puts a premium on social and political stability in society and the economy but has, at the same time, produced extreme and acute agricultural-industrial distortions and vast regional and social inequalities. The gap in incomes between China’s urban and rural areas is, by some statistical reckonings, greater than in any other country in the world, and this is profoundly destabilizing.[9]

D. Reality Check

Cost-minimizing, high-profit, rapid growth is a key objective of China’s ruling class. It is based on the exploitation of wage labor and peasant labor—on the blood and bones of the Chinese people. It is chaotic, ruinous, and environmentally disastrous economic development.

Five of the ten most polluted cities in the world are in China. The Three Gorges Dam project, the scale of which is unparalleled in human history, has massively destroyed ecosystems and uprooted huge populations. Ravenous commercial development is destroying farmland at a quickening pace (farmers are pressured by local government officials to sell their land-use rights and are barely compensated). China has now lost half of its wetlands. Capitalist development is an ecological disaster. It has been estimated that air pollution, water pollution, and other forms of environmental degradation are responsible for disease and premature deaths claiming the lives of some 400,000 people in China each year.[10]

China’s

economic development is a human disaster:

The Sichuan earthquake in the spring of 2008 took a far greater toll

among China’s poor: shoddily built schools for the less affluent

collapsed and many children died unnecessarily. Peasants must pay

fees for medical services and schooling. A recent survey of the Chinese

health system concluded. “The less well-off increasingly go

without health care altogether.”[11]

In urban China, it is not unusual for low-paid wage laborers in the export sector to work 80-hour work weeks in factories with abominable health and safety conditions. In the West, we hear about the lead paint in toys produced in China, but not about the toxic fumes being inhaled, the injuries suffered, and limbs lost by the workers in those toy factories. According to one Chinese government survey, 72 percent of the country’s nearly 100 million migrant workers are owed unpaid wages—and this is an important source of capital accumulated by private and foreign firms.[12]

Significantly, China’s economic boom of 1990-2002 actually led to a decline in formal wage employment in the urban sector (that is, regular jobs with certain protections and standards), as the state sector sought to achieve greater efficiency and profitability. Much of the new job creation has been in the private sector and especially in what is called the informal sector: insecure and unregulated jobs, casual labor on the construction crews of China’s mega-projects (skyscrapers in the cities, infrastructure for the 2008 Olympics, dam construction in river areas), street trading, and illegal activities.[13]

One expression of these trends is China’s burgeoning “sex industry.” Some women’s groups estimate that China now has some 20 million sex workers, most of whom come from the rural areas to work in red-light districts in the sprawling new industrial and commercial centers.[14]

Rural women face new burdens, with husbands and sons migrating to cities. Their life opportunities are restricted. One of the saddest and least reported social developments in China’s countryside is that women—young women—are committing suicide in unprecedented numbers. This is a far cry from Maoist China, when the struggle against the oppression of women was a central focus of the continuing revolutionary transformation of society.[15]

III.

China as Rising Economic Power

with Strategic Goals

The rapid development of capitalism in China is cohering a China-centered regional grid of capitalist production in East Asia, in which Japanese imperialism plays a major organizing role. East Asia is the most dynamic manufacturing region in the world. China’s rulers are fostering greater economic-political linkages throughout East Asia. China is also building up its capacity to project military power in the region. And it is pushing outward into other parts of the world.

A. Growing Financial Leverage

China has become a major actor in world currency and financial markets. China holds $1.8 trillion in foreign exchange reserves—a store of wealth that is also used as a means of international payments. Foreign exchange reserves come from export earnings as well as from other investment earnings. And China is an extraordinary export machine—the United States imports more goods from China than from any other country. China has now surpassed Japan as the world’s largest holder of foreign exchange reserves. Most of these reserves (for now) are kept in dollars—invested in U.S. treasury securities, U.S. government agency debt, and other financial instruments.

China’s dollar holdings are a source of considerable financial leverage in the world imperialist economy. The U.S. has huge government deficits (it spends more on its wars, social programs, interest payments, etc. than it collects in taxes). The U.S. has huge trade deficits (it imports more than it exports). It borrows huge amounts of capital to cover its international financial imbalances. And, critically, the U.S. depends on countries like China continuing to finance its debt.

In 2007-08, China’s “sovereign wealth funds”—these are vast pools of financial wealth managed by governments—were looked to by weakened Wall Street financial and brokerage firms, like Morgan Stanley, to provide them with much needed capital.

China is a huge importer of fuels and minerals, accounting for nearly 40 percent of world market growth for these goods since 1995. Because of China’s high-speed and globally oriented development on a less-developed technological foundation than exists in a country like Japan—China uses seven times as much energy for the same volume of production as does Japan (and three times as much as India).[16]

And China is seeking to secure access to raw materials to feed its industrial machine. In Latin America and Africa, China is investing in extractive industries and buying up firms. China’s foreign direct investment increased from $1.8 billion in 2003 to $16.1 billion in 2006. About half of this is in natural resource industries.[17]

A competitive scramble is beginning to take shape in Africa for control over oil and mineral supplies. U.S. oil companies have been stepping up their investments in countries like Angola, Nigeria, and Equatorial Guinea. In 2007, the U.S. military also established a new unified Africa Command, AFRICOM. (Prior to this, military deployments were coordinated by commands outside of Africa.) This is a major initiative by U.S. imperialism both to secure oil supplies and control over other natural resources and to incorporate more parts of Africa in America’s “war on terror.” As part of this, the U.S. has been stepping up arms transfers and military support agreements with various African governments.

Since the mid-1990s, China has been stepping up its activities in Africa. China is now Africa’s third largest trading partner. China’s state-owned oil company acquired a controlling share in Sudan’s leading oil company. It has become an investor in Algeria’s oil industry. And it has been making its own investment forays into the oil sectors of Angola and Nigeria. Africa now provides about 30 percent of China’s oil import requirements. Chinese mining firms in search of cobalt, uranium, copper, and other industrial minerals, supported by the Chinese state, have been investing in, extending financial assistance, and forging closer ties with the Democratic Republic of Congo, Zimbabwe, and Zambia.[18]

All this investment and maneuvering on China’s part is miniscule compared to the involvement of the U.S. and Europe in Africa. But there is intensifying rivalry in Africa, and a scramble increasingly involving China is underway.

China is utilizing political and diplomatic ties, weapons sales and training agreements, and low-interest loans to advance its interests. It is ideologically positioning itself in parts of the Third World by criticizing U.S. domination and some of the U.S. policies that squeeze Third World countries. And it is taking advantage of the fact that the U.S. is focused and tied down in the Middle East, where its wars for greater empire are now being waged.

U.S. imperialism has been increasingly targeting China as a strategic competitor. Since 2006, the U.S. Defense Department in its annual survey of China has put competition with China over resources on par with conflict over Taiwan as a potential spark for a U.S. war with China.[19]

It is in the context of China’s rise in the world economy and rivalry with China that we can begin to see U.S. demonization and scapegoating of China: for exporting unsafe foods and medicines, for intellectual property-rights infringements, for human rights violations, and for increasing its military spending.

B. Geopolitical Ambitions and the Russia-China Connection

China’s fast-paced, resource-scarce, and anarchic economic growth, under the dominance of imperialist capital, is objectively driving its emergence as a world power with geopolitical ambitions.

China’s military spending has increased three-fold in the past decade according to estimates by the Stockholm International Peace Research Institute. In 2006, it surpassed Japan as the largest military spender in East Asia, and China now has the third largest military budget in the world.[20] China has been upgrading its naval capabilities, improving its ballistic missile arsenals, and entering high-tech arenas like militarization of space. China’s military spending is incredibly dwarfed by that of U.S. imperialism, but China’s military power is a growing factor in international relations, especially in East Asia.

Coming from a perspective of how to advance the interests of U.S. imperialism, two former U.S. government policy advisers reflect a certain aspect of reality in their depiction of the changing geopolitical situation confronting the United States in this critical region: “After 60 years of U.S. domination, the balance of power in Northeast Asia is shifting. The United States is in relative decline, China is on the rise, and Japan and South Korea are in flux. To maintain U.S. power in the region, Washington must identify the trends shaping this transition and embrace new tools and regimes that broaden the United States’ power base.”[21]

One of the features of the current situation is the growing convergence of interests of China and Russia in key arenas and the multiplication of Sino-Russian ties and cooperation. In 2006, China became the number one economic partner of Russia, and China has also been financing important Russian pipeline projects—which will be discussed in the next installment of this series.

Both China and Russia are providing arms to oil and gas producers in the Third World. Both are increasing their military capability in key energy producing regions. And both powers joined together in 2001 to form the Shanghai Cooperation Organization of Central Asian countries.

The Shanghai Cooperation Organization (SCO) is a major development in world relations. China’s economic growth and rise in the world economy are increasingly finding expression in the geopolitical and military realms. The SCO is a regional energy alliance and a regional security alliance in Central Asia. Its core member states are China, Russia, Kazakhstan, Kyrgyzstan, Tajikistan, and Uzbekistan.

The SCO is bringing together Chinese economic strength with Russian military capability and energy resources. In the summer of 2007, the SCO conducted its first military exercises. This was also the first time that Chinese airborne troops were deployed outside Chinese territory.[22]

The SCO is clearly aimed at reducing and countering U.S. influence in Central Asia and at concentrating certain strengths, and overcoming certain weaknesses, of Russia and China—and drawing others around them. This is a fledgling but significant vehicle of rivalry in a volatile, energy-rich region of the world.

C. Some New Questions

Some new questions are posed by China’s rapid ascent in the world economy.

Could China “decouple” (the phrase is used by financial as well as by geopolitical analysts) from its reliance on the U.S. export market and abandon its willingness to finance U.S. deficits?

In the short run, the answer seems to be a resounding no—given the huge shocks this could set off (China would stand to lose billions if it quickly bolted the dollar and caused the value of the dollar to plummet) and the fact that China’s dependent and distorted development requires export markets on a huge scale. It appears that China cannot easily switch to stimulating domestic demand as a substitute for Western export markets.

In the intermediate and longer term, the possibilities for “decoupling” look rather different, especially in connection with other world economic and geopolitical shifts.

China’s high rate of growth and the profitability it has afforded imperialist capital have been a vital stimulus to the world economy, including U.S. imperialism. At the same time, a more cohesive and competitive West European economic bloc, the European Union, is now playing a more major role in the world economy and world finance.

Still, as mentioned at the start of this analysis, the U.S. occupies the primary position in the imperialist world economy. And owing to China’s deep immersion in the imperialist world economy, if it suffers the full brunt of what might be an unfolding global economic downturn this could have huge and destabilizing feedback effects, both on China and on the world economy. How China and the U.S. respond to and come out of the 2008 financial crisis may have long-term, geopolitical ramifications.

China has been able to sustain high growth rates. But it is a capitalist economy. It is not immune to instability and crisis. It is estimated that 75 percent of China’s industries are plagued by overcapacity, that is, too much investment relative to markets.[23] Inflation is heating up in China. Social polarization is widening: strikes, protests and confrontations in the countryside over corruption, land takeovers, and environmental damage have multiplied in recent years.

The dynamics of China’s rise are complex. There is, however, a shaping contradiction: dependency and growing economic strength. China is dependent on foreign capital and foreign markets. But China has also emerged as a world economic power, a center of world manufacturing. It has accumulated vast foreign exchange reserves, and gained considerable financial leverage—increasingly over the dollar. And China is more aggressively seeking markets in the Third World and exporting capital beyond its borders.

Stepping back, what seems to be guiding the Chinese ruling class is a long-term, strategic, and competitive orientation: to diversify and fortify a domestically rooted industrial base, to extend international economic and financial reach, and to strengthen military capabilities but to do so without provoking direct showdowns with U.S. imperialism.

Could China evolve into an imperialist capital formation? It is a question that cannot be dismissed out of hand, though neither is it a straight-line, foregone conclusion. But it is a real possibility—China may be in a stage of transition to becoming an imperialist power. How likely is such a qualitative development, and by what pathways might it proceed? These are historically contingent matters that will turn on the interaction of the motion and development of Chinese capitalism with the class struggle in China, with larger shifts, displacements, and eruptions in world economics… and with big and unexpected developments in world politics, including wars and other conflicts, as well as revolutionary struggles.

Next, Part 3: The European Union, Russia, Japan, and India

Footnotes:

1. Keith Bradsher, “Labor Costs Soar in China, So Its Neighbors Beckon,” New York Times, June 18, 2008; John C.K. Daly, “Feeding the Dragon: China’s Quest for African Minerals,” China Brief, January 31, 2008, jamestown.org; Energy Information Administration, Country Analysis Briefs: China, August 2006, eia.doe.gov.[back]

2. Wu Qi, “China Regulates Foreign Mergers for More Investment,” September 11, 2006, china-embassy.org.[back]

3. Wang Zile, “Foreign Acquisition in China: Threat or Security,” China Security, Vol. 3, No. 2 (Spring 2007), p. 90.[back]

4. U.S.-China Business Council, Forecast 2008: Foreign Investment in China, p. 1.[back]

5. U.S.-China Business Council, Forecast 2008: Foreign Investment in China, p. 3; CIA, World Fact Book: China, cia.gov.[back]

6. Nicholas Lardy, “Trade Liberalization and Its Role in China’s Economic Growth,” imf.org.[back]

7. Charlemagne, “Winners and losers,” The Economist, March 1, 2008, p. 56.[back]

8. On the state sector, see Arthur Kroeber and Roselea Yao, “Large and in charge,” Financial Times, FT.com, July 14, 2008.[back]

9. Mobo Gao, The Battle For China’s Past: Mao and the Cultural Revolution (London: Pluto, 2008), pp. 160, 179; Joseph Kahn and Jim Yardley, “Amid China’s Boom, No Helping Hand for Young Qingming, New York Times, August 1, 2004.[back]

10. Elizabeth Economy, “China vs. Earth,” The Nation, April 19, 2007; Jim Yardley, “China’s Turtles, Emblems of a Crisis,” New York Times, December 5, 2007; L. Alan Winters and Shahid Yusuf, eds., Dancing with Giants (Washington D.C.: World Bank, 2007), p. 14.[back]

11. Li Onesto, “The Capitalist Ground Shaken by the Earthquake in China,” Revolution #131, June 1, 2008, revcom.us; Sanjay Reddy, “Death in China: Market Reforms and Health,” New Left Review 45, May-June 2007.[back]

12. Anita Chan, “A `Race to the Bottom,’” China Perspectives, no. 46 (March-April 2003), p. 43; David Harvey, A Brief History of Neoliberalism (London: Oxford University Press, 2005), p. 148.[back]

13. Martin Hart-Landsberg and Paul Burkett “China, Capitalist Accumulation, and Labor,” Monthly Review, May 2007, pp. 28-29.[back]

14. Howard W. French, “The Sex Industry is Everywhere But Nowhere,” New York Times, December 14, 2006, cited in Hart-Landsberg and Burkett, p. 29. [back]

15. Robert Weil, “Were Revolutions in China Necessary,” Socialism and Democracy, Vol. 21, July 2007, pp. 20-22.[back]

16. Winters and Yusuf, Dancing with Giants, p. 14; Parag Khanna, The Second World: Empires and Influence in the New Global Order, New York: Random House, 2008, p. 313fn.[back]

17. PPI, “Chinese Direct Investment Abroad Has Grown Twenty-Fold Since 2000,” October 21, 2007, ppionline.org. [back]

18. On great power competition for resources in Africa and China’s growing economic presence in Africa, see Michael T. Klare, Rising Powers, Shrinking Planet (New York: Metropolitan Books, 2008), Chapter 6; Jian-Ye Wang and Abdoulaye Bio-Tchane, “Africa’s Burgeoning Ties with China,” Finance and Development (IMF), March 2008, Vol. 45, No. 1; David H. Shinn, “Africa, China, The United States, and Oil,” Africa Policy Forum, forums.csis.org. [back]

19. Michael T. Klare, “The New Geopolitics of Energy,” The Nation, May 1, 2008, thenation.com.[back]

20. Stockholm International Peace Research Institute, Recent trends in military expenditure (Stockholm: 2008), sipri.org. [back]

21. Jason T. Shaplen and James Laney, “Washington’s Eastern Sunset: The Decline of U.S. Power in Northeast Asia,” Foreign Affairs, November-December 2007, online edition, summary, p. 1, foreignaffairs.org. [back]

22. On the Shanghai Cooperation Organization, see Bates Gill and Mathew Oresman, “China’s New Journey to the West” (Washington, D.C.: Center for Strategic and International Studies, 2003), pp. 5-12; See also, Klare, “New Geopolitics of Energy.” [back]

23. Ho-fung Hung, “Rise of China and the Global Overaccumulation Crisis,” Review of International Political Economy, 15:2, May 2008, p. 159.[back]

Glossary:

Accumulation of capital. The production of surplus value (the source of profit) based on the exploitation of wage labor; and the investment and reinvestment of profit by competing capitals on an expanding, cost-cheapening, and technologically more advanced (and productive) basis. This is a process, as Marx said, of the accumulation of wealth at one pole and misery and agony of toil at the other.

Capital export. The outward flow of investment capital from one country to another. Capital export consists of foreign direct investment in an existing enterprise of the host country or the building of new facilities (as when GM opens a factory in China), and other forms, such as bank loans, investments in stocks and bonds, etc.

Imperialism. The stage of development of capitalism as a world system of exploitation reached in the late 1800s. We live in the age of imperialism. Imperialism involves five key features: a) the dominance of monopoly (large, highly centralized, and powerful units of ownership and control) over the organization of production and distribution; b) the merging of banking and industrial capital into huge financial blocs; c) the central importance of the export of capital to overall profitability; d) the economic division of the world by large corporations, cartels, and the great powers into spheres of influence; and e) the complete territorial division of the world by the imperialist powers into colonies, neocolonies, and zones of influence, so that struggle between the leading imperialist powers will involve the re-division of the world.

The bourgeoisie. The ruling class of capitalist society. This modern exploiting class commands private control (ownership) over large-scale, highly developed, social productive forces—workable only by the collective efforts of a class, the proletariat which, dispossessed of means of production, must sell its labor power in order to survive. The bourgeoisie embodies the capitalist imperative to expand or die. It stands in antagonistic relation to the proletariat. It enforces its rule over society through control of the state and its organs of repression and force.