An Update On Global Net Oil Exports: Is It Midnight On The Titanic?

By Jeffrey J. Brown

25 April, 2012

Energy Bulletin

The Association for the Study of Peak Oil & Gas, USA is hosting a series of online webinars, as a service to members. With a minimum donation of $100 (greater amounts are always appreciated), one can join ASPO-USA and have full access to the webinars, or you can pay a one time fee of $40.

I will be delivering the next webinar, Thursday afternoon. Art Berman will be delivering a webinar on May 17th, covering the shale oil plays in the US. For more info, go to http://www.aspousa.org/index.php/aspo-usa-webinar-series/

My thesis is that US oil industry continues to make a serious mistake by providing, in my opinion, wildly unrealistic scenarios for US and global crude oil production. For example, ExxonMobil has run ads stating that we won’t see a global production peak for decades to come, while Daniel Yergin tells us that the worst case is an “Undulating Plateau” many decades from now.

Unfortunately, since global annual crude oil production has been flat to down since 2005, the “Undulating Plateau” seems to arrived slightly ahead of schedule.

Global annual (Brent) crude oil prices doubled from $55 in 2005 to $111 in 2011, an average rate of increase of one percent per month, although actual prices have of course been above and below this trend line. The available production data over this time frame, from the EIA and BP, show that global crude oil production and global total petroleum liquids production have been virtually flat, with a slight increase in total liquids production of about 0.5%/year (inclusive of low net energy biofuels).

A study of the top 33 net oil exporters in the world, which account for 99% plus of total global net exports, and which we define as Global Net Exports of oil (GNE), shows that GNE fell from 46 mbpd (million barrels per day) in 2005 to 43 mbpd in 2010 (BP & minor EIA data, total petroleum liquids).

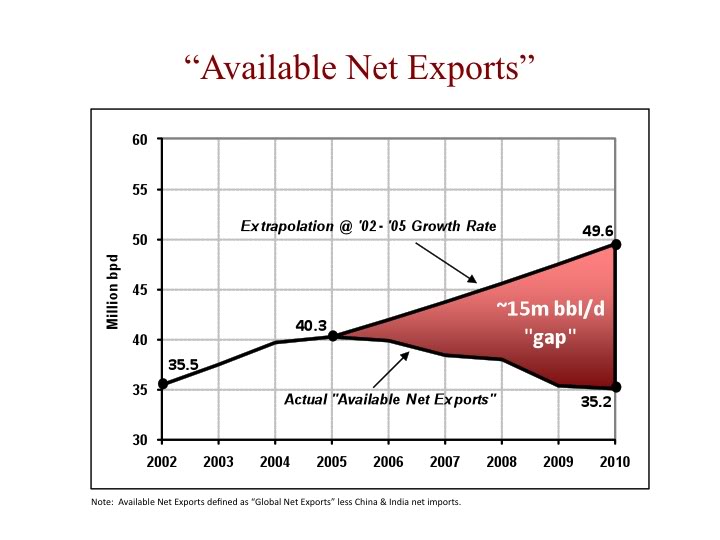

Furthermore, China and India (“Chindia”) have been consuming an increasing share of this declining volume of GNE. At the 2005 to 2010 rate of increase in Chindia’s combined net oil imports as a percentage of GNE, the Chindia region alone would consume 100% of GNE by the year 2030, 18 years from now. I define Available Net Exports (ANE) as GNE less the Chindia region’s combined net oil imports. Following is a link to a chart showing the 2002 to 2010 ANE numbers, along with where we would have been in 2010, at the 2002 to 2005 rate of increase in ANE.

While the US has shown a small increase in crude oil production, up from the pre-hurricane rate of 5.4 mbpd in 2004 to 5.7 mbpd in 2011, a net increase of 0.3 mbpd, this is virtually a rounding error in the context of the multimillion barrel per day declines that we have seen in GNE, especially the ongoing decline in the volume of GNE available to importers other than China and India, which dropped from 40 mbpd in 2005 to 35 mbpd in 2010.

And while it is certainly true that US net oil imports have declined, a significant contributor to the decline in net imports was a large decline in US consumption, which was down by 1.5 mbpd from 2004 to 2010 (EIA).

So, while slowly increasing US crude oil production is very important, the dominant trend we are seeing is that developed oil importing countries like the US are being gradually priced out of the global market for exported oil, as global oil prices doubled from 2005 to 2011, and as developing countries like the Chindia region consumed an increasing share of a declining volume of global net exports of oil. For more information, you can search for: Peak Oil Versus Peak Exports. [article at Energy Bulletin]

The Titanic hit the iceberg at 11:40 P.M. on the evening of April 14, 1912. At midnight, only a handful of people on the ship knew that it would sink, but that did not mean that the ship was not sinking. The Titanic’s pumps helped, but they could not fully offset the flow of seawater into the ship. In my opinion, slowly rising US crude oil production is to the ongoing decline in Global and Available Net Exports as the Titanic’s pumps were to the flood of incoming seawater.

From ASPO-USA Upcoming Webinars:

Thursday, April 26, 3:00 - 4:30 pm Eastern

Global Oil Exports: Smooth Sailing or Midnight on the Titanic?

Featuring Jeffrey J. Brown - Independent Petroleum Geologist, Creator of the Export Land Model, ASPO-USA Board Member

This session will review major trends regarding availability of oil exports on the world market, and the growing tension between oil production and rising internal demand of oil-producing nations as well as China, India, and other emerging economies. Key topics to be addressed include:

>> Review of fundamental export trends and projections for demand growth in oil-producing and developing countries.

>> Critical discussion of export data in the context of overall constraints for world oil supply.

>> Projected timing for reaching critical impasses in the world oil export market.

>> Analysis and discussion of potential scenarios

Jeffrey J. Brown is an independent petroleum geologist in the Dallas, Texas area. He is also a member of ASPO-USA board of directors. His website is http://www.graphoilogy.com/

Due to a recent spate of abusive, racist and xenophobic comments we are forced to revise our comment policy and has put all comments on moderation que.