Speculation , Scams, Frauds and Crises:

Theory And Facts

By Sunanda Sen

11 February, 2009

Countercurrents.org

The Background

It is common knowledge that the possibility of moving funds can add to the prevailing incentives for speculation in the financial market. De-regulation of the financial sector also makes for financial innovations as are geared to handle the uncertain prospects relating to asset-prices and their returns. Instruments as are innovated in the process include financial derivatives like futures, options and swaps which are all contracted on the basis of what has been described as the ‘underlying', comprising of securities, currency, commodities or even real estates.

Agents who operate in the financial markets face tasks which require different types of professional skill and expertise. One witnesses, as a consequence, the emergence of what can be described as a division of responsibilities, between those who manage, mobilise and deploy resources at their respective financial businesses, and those who undertake what can be described as ‘risk management' in the face of uncertainty. The latter, by definition, entails financial engineering, aiming to sustain and maximise net returns of these financial assets in uncertain times. Strategies as above entail a balancing of risks by returns, which may not always be successful.

It is worth a mention here that with a major part of financial flows geared to uncertain activities including those on hedge funds, returns on finance today can only be sustained by volatility in finance itself . This is evident in the calculations of the call/put premiums in the stock market which often rely on the much celebrated formulations of Black, Scholes and Merton in the standard models of stock markets. The formula indicates that those premiums move up only when stock prices are subject to a wider range of variance .

Dwelling a bit on derivatives in financial markets, popularly known as hedging, use of these financial instruments is common under uncertainty. Hedging includes ranges of derivative instruments (forwards, futures, options, swaps etc) generating windfall gains/losses in volatile markets. While reliance on these instruments adds to the transaction cost of each financial deal, the capital gains/losses on these transactions, in terms of standard convention in national accounts, are treated as transfers, which are not entered into national output calculations. The multiplicity of financial investments as rely on derivatives, while originating from the same base in terms of specific real activities (or ‘underlying'), do not expand the base itself. Instead, these amount to a piling up of claims which are linked to the same set of real assets. Finance in its upswing thus becomes increasingly remote from the real economy; while financial innovations proliferate in the economy, to hedge and insulate financial assets in the presence of uncertainty.

To understand fully the implications of financial market activities on the real economy, we need to distinguish between the new and old stocks as are transacted in the market. The two can have impacts on the real economy which are very different from each other. This is because while new stocks sold in the primary market generate demand for real investments, the same stocks, when resold in the secondary market do not necessarily contribute to new investments even when these transactions generate buoyancy in these markets by pushing up the prices of stocks. Thus rising profits (capital gains) on old stocks of a firm, as has been empirically observed, do not necessarily signify increased demand and higher prices for the new stocks launched by the same firm. This challenges the argument that a positive change in the Tobinesque ‘ q ' in the event of an upswing will also raise the demand for new stocks. As can be witnessed, contrary to what is postulated in the rational expectations approach underlying mainstream theory, capital markets have failed to serve as an informational/signalling agent in the real economy. It is but natural that the capital (financial) market does not necessarily contribute to efficiency in the financial sector or growth in the real economy. Incidentally, it can be pointed out in the above context that uncertainty (and knowledge) are subjective and hence ‘non-ergodic'. Uncertainty is thus not a natural phenomenon which is time invariant. Accordingly it is ontological and is embedded in social reality which, as described by Shackle, is ‘kaleidoscopic' and relates to what Joan Robinson called ‘historic time'. Aspects as these make it rather tenuous that speculation in financial markets would necessarily work in sustaining profits, as is evident with what has been happening in the global economy at the moment.

The impact of changes in the financial sector on the real economy, however, sharply differs when it shrinks. Initiating a narrowing of the real economy, impact of these financial sector disruptions are much more pervading. The underlying asymmetry can be explained by the dual exposures which the real economy bears to the financial sector: First, with financial assets as are held by the real sector, a drop in their prices has a second round impact ( wealth effect) via a related drop in real demand in the economy. Second, at a micro level, such reductions in the prices of financial assets mean a proportionate decline in the net asset value for financial institutions. Both of these relate to the exposures of the real economy to the financial,an evidence of which relates to the the on-going spate of output contractions and job losses in different parts of the world, much of which has its origin in the recent financial crisis.

With the prevalence of high stakes in financial markets which are subject to uncertainty, risks often turn out to be disproportionately high as compared to their realized returns. Transactions under above situations have been identified in the literature as ‘ponzi' deals, which, as characterized by the post-Keynesian economist Hyman Minsky in 1986 , are both unsustainable and hazardous as compared to acts of simple hedging (or even speculation) on asset prices. With ponzi finance the high returns offered by borrowers to entice new lending often fail to be realised by them when actual investments in the market yield lower returns. To avoid an impending default and an interruption of business, borrowers find it necessary to further continue with new borrowings and investments in order to compensate the losses incurred on earlier investments. However, as confidence on financial assets on the basis of these transactions tends to erode, such dealings come to a grinding halt, leading to big holes in the balance sheets of the concerned parties.

Ponzi deals, however, are very different from hedge finance which to some extent keeps the business going (as long as hedging offsets the losses with possible gains). Even speculatory finance, which takes on more risks than those under hedging, can be sustained until it becomes ponzi, with borrowings at high rates no longer generating compensating returns; a situation which today has plagued the global financial markets.

Crises, scams and frauds - From sub-prime loan crises to Madoff scam and the Satyam fraud:

Analysis outlined above helps to explain the successive crises in the global financial markets as have currently come out into the open. These include the collapse of the sub-prime loan market in USA and its repercussions, the recent Madoff scam in US , and the fraud in a giant IT firm Satyam in India which is still unfolding All those indicate, in our view, unsuccessful hedging and speculation in de-regulated financial markets as happens in a ponzi scheme.

Successive disruptions in the functioning of financial markets, as in recent times, indicate the extent of inadequacy in these risk-management strategies. These failures hadled to the crisis in housing markets of USA, which by mid-2007,ended up in a turmoil engulfing almost the entire global market, both financial and real; and pushing a large number of countries into a deep recession. Financial markets have shrunk further over 2008 and asset prices plunged, to levels as have never been witnessed before. In US, the NASDAQ (stock price index of the New York stock exchange) fell from 2800 on December 1, 2007 to less than 1300 in November 2008. Similar declines in stock prices could also be observed in other parts of the world economy, encompassing not just the advanced countries but also the developing area. A large number of financial institutions in those countries have faced liquidation or are close to it. Repercussions in the real sector which followed include drop in output and closures of industrial units along with massive cuts in jobs all over the world.

Securitisation of Assets and sub-prime Loans

Limits to financial business by using leveraged finance with the help of derivatives are amply demonstrated in the turmoils of financial markets today. Use of Asset-based Securities (ABS) along with other derivatives like Credit Default Swaps (CDS), Collaterised Debt Obligations (CDOs) and the Structured Investment Vehicles( SIVs) were prominent in the US sub-prime loan market which has already collapsed. Financial innovations using these devices provide alternate channels of credit and insurance cover with augmented leverages which are beyond the usual banking orbits. A large part of these deals also remain off- balance sheet and are traded Over the Counter (OTC).

As the process continued, large numbers of people with low incomes were then endowed with mortgaged property and a liability to pay monthly instalments, usually to the broker-mortgager cum bank which organised the deal. These assets were backed by loans which later were discovered as ‘sub-prime', with mortgaged collaterals subject to valuation in a sliding market, loans at interest rates higher than the ruling rate in the market, and with poor accountability of the borrowers, many of whom were not bankable in terms of the conventional practices followed earlier. The euphoria , fed initially by the rising property prices on the one hand and the eagerness on part of the financial community to profit ( by using the securitisation route )on the other, did work as long as it lasted. All this business, led by investment banks, was outside the purview of the Fed. These sub-prime loans which prompted the upswing in the asset market of US eventually failed to work as property prices started falling in an inflation-rigged economy.

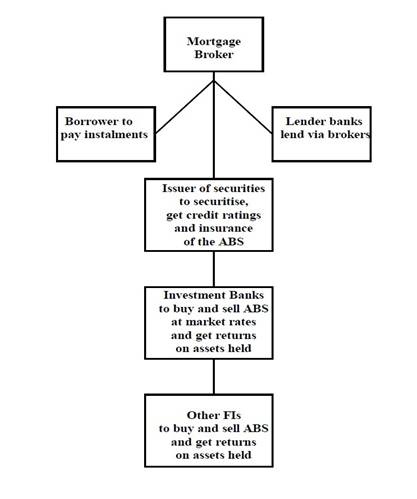

To follow the sequence as led to the collapsed sub-prime loan market of the US we provide below a rough sketch of the possible links in the system:

Crisis in the US sub-prime loan market did not stay within the confines of the same market. As can be expected, the various counterparties linked to the new fangled derivative devices (involving ABS, CDO, CDS) along with the high leverages pulled down a large number of financial houses in US, and in other parts of the world. It did not take much time for real sector transactions to face contractionary impacts, both with the drop in asset prices and the reduced demand for output. The sharp drop in production and job losses in different parts of the world already bears a vivid testimony to such an impact.

Securitisation with other Loans

Crisis in the sub-prime loan market has its close analogue in other transactions involving the creation of financial assets. These included the securitisation of loans on credit cards, housing and car loansetc. Assets as above were sought to be insured by credit default swaps (CDS) while their repackaging generated opportunities of resale and further leveraging by those who held them. In the meantime the financial market had its own pace of expansions, contractions and volatility, none of which can be controlled by the monetary authorities.

Scams and Frauds in Recent Times

To add to the current waves, of late we are witnessing disruptions in financial markets and institutions which are of a different genre. These include the $50bn deceit reported for Bernard L Madoff Securities, one of the best known financial houses in US, casting a gloom for many financial corporates in US and in other advanced countries which had on-going transactions with Madoff Securities. In India there has been a Rs 700 crore ( about $200mn) scam in Satyam Computers , one of the top four IT companies in the country, which have been together responsible for more than $40bn of exports from India in 2007-08. Satyam was also providing no less than 50 thousand jobs for professionals in the country. There may be more of such irregularities and forgeries which have not yet come out in public.

These are slightly different but equally malicious aspects of the financial markets as have been much in news today. These have further shaken the financial markets which had already been in a state of shock since the beginning of the third quarter of 2008. Those hard hit included similar other hedge funds. In US alone, a combination of performance loss and redemptions, according to unofficial estimates, have already pushed down hedge fund assets by $500mn during 2008 . A crack down on hedge funds followed as a logical step with Congressional Hearings in January pointing at the need to have due diligence to stop frauds by hedge funds.

In India the current concerns are with Satyam Computers, a top IT company, the chief of which (Ramalinga Raju) has admitted of having committed a similar financial crime worth Rs 500 crores (which is nearly $200 mn) over some years. His attempts to defraud by acquiring the assets of an infrastructure company which was owned by a family member had already led to questionings by the company's share holders who stopped it.

Looking at the records of failures, deceit and fraudulent business practices which so far have come out in the open, the two instances( Madoff Securities and Satyam Computers) share a similar pattern, using ponzi finance where liabilities are created much in excess of assets which often do not even exist. These involve defrauding on an wide scale by individuals who managed to appropriate the exclusive responsibility of handling the finance portfolio of these units. As pointed out by analysts, these involve, in general, “ the writing of secret contracts” with CDSs involving other companies. The recent upsurge in the demand for CDS in financial markets to insure the deals indicate the limited access the buyers of these ABSs have to the underlying instruments to back the latter. According to unofficial estimates by end of 2008 the CDS market in US was between $34 to $54bn. As described by a columnist, these indicated “ an unregulated market of darkness”.

Control Fraud?

Generalising the patterns of scam and forgery as have become common in corporate governance, attention has been drawn in the literature to the notion of “control fraud”, by the CEO or other corporate authority who can operate as “super-predators of the financial world”. These involve an elite-orchestrated “ looting of the firm” such that “..a single large control fraud can cause greater financial losses than all other forms of property crime combined” Also “..frauds, by definition, are hidden and elite frauds, e.g., the CEO that loots a firm by using abusive accounting to create fictional profits that make his stock options valuable, may never be discovered.” The argument is best captured by the titlt of a book written in the context of the S&L crisis. It runs as “ The Best Way to rob a Bank is to Own itself”! It has further been claimed that despite a formal facade of corporate governance, these chiefs or the CEOs enjoy at least four important privileges. These include the ability to “suborn internal and external controls and pervert them into allies,......(e.g.,) unique ability to “shop” for an auditor that will aid their looting...” They can also “optimize(s) the company by having it invest primarily in assets that have no readily ascertainable market value” Third, “CEOs have the unique ability to convert company assets into personal funds through seemingly legitimate corporate mechanisms. Accounting fraud is the key to this conversion. Fourth, the CEO has the unique ability to influence the external environment to aid is fraud.” As it has also been pointed out, the above tendencies are often facilitated by standard neo-classical theories of law and economics which often advocate “..policies that optimize a criminogenic environment to control fraud.”

What can be the way out?

Dwelling on the policy implications, we go back to the central argument of this paper on the systemic crisis in finance which results from speculation under de-regulation of the financial markets with an unrestrained use of derivatives therein . By making possible the free entry and exit of players in the market, financial liberalisation encourages short-termism, which fail to generate real assets in the long run. L oopholes as exist in the high -risk high-profit strategies follow under uncertainty ; especially when resort is made to ponzi finance with costs of borrowing exceeding the returns on investments . We have also drawn attention to the rising turnover in stock markets which to a large extent are made possible by derivatives ( e.g, futures or options ) since cash needed for transactions can only be a margin ( percentage of the latter) deposited with the exchanges. There also exists, under de-regulated finance, the possibility of securitis ing all assets (ABSs) , generating what can be described as a pyramid of counterparties with successive transfers of risks along the multiple ABSs . However these operat ions , backed by default swaps (CDSs) and other structural investment vehicles (SIVs), can continue only as long as confidence in the market is capable of sustain ing mutual trust. The problem aggravates as defaults and bankruptcies proliferate with scams and fraudulent practices. With uncertainty extorting a heavy discount on expectations , the investor naturally prefer s to move away from long to short-term assets which are necessarily liquid. Similar to Keynes's liquidity trap, this characterises the tendencies to hold on to relatively liquid assets in a money/credit economy. With easy availability of credit under de-regulated finance and access to information technology, perceptions are not only subjective but also prone to quick revisions. This explains the bandwagon effects as are frequently observed in the financial markets. S ince profits on speculation turn out to be rather transitory, tendencies for a tapering off calls for a systemic crisis in frequent intervals. There follows the sequential impact on the real sector in terms of severe declines in output and employment.

R ecent happenings in the financial markets and the real sectors in US, followed by a similar state of affairs in other countries, indicate a picture as above. Reflecting on the possibilities of mending similar situations , it can be held that knowledge (and its opposite, uncertainty) can improve if institutions like contracts and conventions along with the market makers, remain ‘stable'; a situation which warrants strategies with effective intervention and stabilisation on part of the regulatory authorities. The problem, however, will still persist if there is a lapse in governance , especially, in terms of the ability of the counter-forces to contain the forces of instability and contraction .

We now offer a set of concrete proposals as may be relevant in abetting the current instability and contractions in the world economy. In general there has to be a mechanism to control short-termism and speculation in financial markets. This requires a reversal of the prevailing spate of financial de-regulation, especially, in the security sector. As with banks , surveillance of the national monetary authorities which include the respective central banks is also needed for the security market with a set of regulations which should be mandatory , and preferably monitored by statutory bodies like the central banks at a national level. In this context the inadequacy of organisations like the International Organisation for Securities Commisions (IOSCO) and the Financial Stability Forum or the Bank for International Settlements (BIS) needs to be recognized, a fact which calls for a change in the approach to financial stability. Given the tendencies for banks to be over-exposed to the security market and thus be subject to added degrees of uncertainty in a sagging security market, we recommend a revival of the earlier pattern of segregated banking where banks were not permitted to invest in the security markets.

The second important route for controlling speculation in the financial market is to curb and monitor the use of derivative financial instruments, including the ABSs. To render their use consistent with the overall macro-economic policies of the country these instruments should be subject to surveillance by national monetary authorities and not just by those who regulate the security markets ( e.g, SEC in US and SEBI in India). This would help in identifying the spate of speculatory transactions in financial markets which today remains as anybody's guess.

Finally the crash in the credit market and the related collapse of financial institutions as well as other establishments as has come about needs to be handled differently than what has been recently experimented in US and other countries with bail-outs and in India with cheapened credit rates and pumping in of liquidity with banks. Credit can not be created in absence of its demand which in a sagging real sector is not possible. The remedy lies in direct transfusion of purchasing power and creation of jobs by fiscal means, which the Obama administration in US has finally realised.

As for India there is , in addition, a need to put a brake on certain measures of capital account liberalisation e.g, with free entry of FIIs and their play in stock markets since 1992 ; and to other measures of liberalisation in the financial market introduced in recent times . These should reverse the liberalisation of the Participatory Notes (P-Notes) which come and go from abroad without a need to disclose their identity. Derivatives which are widely used to hedge and speculate in stock s and currency markets with futures, options and related instruments are subject to a turnover which is disproportionately large as compared to the ir respective spot market transactions. This has been facilitated with the official sanction in 1999 to use derivatives in parity to spot transactions. These measures need to be reversed with active official steps as are needed.

Measures as above may dampen the incentives to move away from real sector investments to the financial which used to be more profitable. However, demand and profitability of real sector investments would only expand with direct fiscal expansions to revamp this sector. Incidentally, monetary measures to instil liquidity in the system ( as was done in US under the Bush administration and already practiced in India by the RBI ) would not work for credit expansions unless the economy expands and generates adequate demand for credit. This demands a shift in priorities with fiscal expansion and real sector growth taking precedence over monetary measures to instil credit.

Curbs on speculatory finance and an aggressive expansionary fiscal policy are the answers to what has gone wrong in the world today.

__________________________________

Black, Fischer and Scholes,Myron” The Pricing of Options and Liabilities” Journal of Political Economy 1973 Vol 81 no 3 pp637- 54.

Merton Robert C,” Theory of Rational Option Pricing” Bell Journal of Economics and Management Services 1973 Vol 4 no1 pp141-83

cited in Sunanda Sen, Global Finance at Risk: On Real Stagnation and Instability Palgrave-Macmillan Houndsmills 2003 p 88

Tobin's q , is the ratio of the market value of a firm's assets (as measured by the market value of its outstanding stock and debt) to the replacement cost of the firm's assets. Tobin J, ( 1969) "A general equilibrium approach to monetary theory", Journal of Money Credit and Banking , Vol 1No 1 pp 15-29

Shackle,GLS, Keynesian Kaleidics: The Evolution of General Political Economy Ddinburgh University Press. Cited in Sen op cit.,p25

Pressman Steven,”What do Capital Markets do? And What should we do about Capital Markets?” Economie et Societé 1996 Serie M.P no 10 2-3 pp193-209

Hyman P Minsky, Stabilizing an Unstable Economy New Haven, Yale University Press 1986

Davidson Paul, “ A Technical definition of Uncertainty in the Long-run Non-neutrality of Money Cambridge journal of Economics September 1988

Also,” Is probability Theory Relevant for Uncertainty? A Post-Keynesian Perspective” Journal of Economic Perspectives Vol 5 no 2 1991 pp 129-43

“ Money Flows out of Hedge Funds at Record Rate” Financial Times ,December 30,2008

“ Crackdown on Hedge Funds after Madoff Affair” Financial Times December 29.2008

Paul Martens, “A Two Trillion Dollar Blackhole” Counter Punch November 13, 2008

Black William K, The Best Way to Rob a Bank is to Own One Austin TX 2005

Also Black Williams K, “ When Fragile becomes Friable : Evidence Contro; Fraud as Cause of Economic Stagnation and Collapse” (mimeo) 2005

“Thus, Enron boasted of creating the “regulatory black hole” that left energy derivatives unregulated. Enron exploited this systems capacity limitation to form a cartel and produce the California energy crisis by taking production plants off line. During the S&L debacle the most audacious control frauds used their political contributions to fend off the regulators by influencing key members of the Reagan/Bush administration and Congress CEOs use the company's assets to burnish its apparent legitimacy by making charitable contributions. The political and charitable contributions also enhance the CEO's status and reputation.” See Black (mimeo) op.cit

This view is based on the notion that uncertainty and knowledge are both ‘gradable'. Thus ‘. . . if uncertainty is gradable, government action may reduce it and thereby increase confidence'. David Dequech “Different Views on Uncertainty and some Policy Implications ”in Paul Davidson and Ja Kregel,(eds) . Improving the Global Economy Edward Elgar London 1995 cited in Sunanda Sen op.cit p 28