Countdown To $100 Oil: A Date With History?

By Euan Mearns

12 July, 2011

The Oil Drum

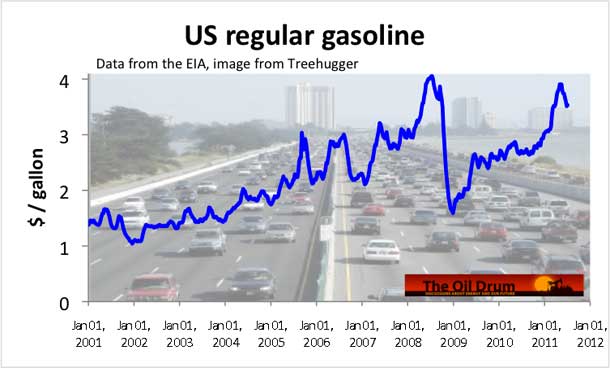

On two past occasions, the average annual oil price has hit $100 per barrel and this has been followed by recession. At time of writing (7th July) the annual average for Brent was $95.4, on course to breach $100 some time in September. Will history repeat itself? Or has the global economy grown immune to high energy prices?

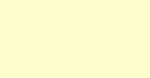

US regular gasoline prices mirror moves in the crude oil market. The overwhelming desire is to bring gasoline and other energy prices down. But politicians and policy makers must understand that if we see $2 gas in the near future it will most likely be due to peak oil recession #2 and that is not what they want. They must start pointing the finger at themselves. Borrowing and printing money creates demand that drives energy prices up.

A simple peak oil model

A simple model that has become popular among bearish peak oil commentators is that high oil prices, caused by growing scarcity of cheap oil, may lead to recession. As consumers spend more on gasoline and other energy services such as electricity and natural gas the amount left over to spend on iPads, wine and vacations becomes less, causing recession throughout non-energy parts of the economy. High energy prices also lead to inflation that in a monetarist world should be squashed by higher interest rates though central bankers seem all too aware now that higher interest rates and high energy prices would kill economic growth in many OECD countries and in so doing drive many major, over indebted, economies toward insolvency.

Over the course of world history the average annual oil price has peaked to values close to $100 (adjusted to $2009) on only two occasions in 1979 and 2008 (data from BP 2010). On each occasion, deep recessions followed. Is this chance? Or is it the case that the global financial system actually runs on cheap energy and not cheap money? Just three years after the last peak we are once again testing the $100 threshold and it will be intriguing to see if history is repeated. The source of real worry for national governments should be the observation that the cost of producing new oil reserves is fast approaching this notional $100 threshold. Should the cost of adding marginal oil supply ever exceed the price that the global economy can afford to pay, then global oil production will fall as natural declines exceed new supplies.

This simple model (simplistic model?) is based on only two data points in 1979 and 2008, but it looks increasingly likely to be tested again within the next two to three months as stubbornly high oil prices (Brent) drag the annual average ever higher toward that $100 mark. Hamilton (2011) observes links between oil shocks and economic downturn in each post WWII oil crisis 1956/57; 1973/74; 1978/79; 1990/91 and 2007/08.

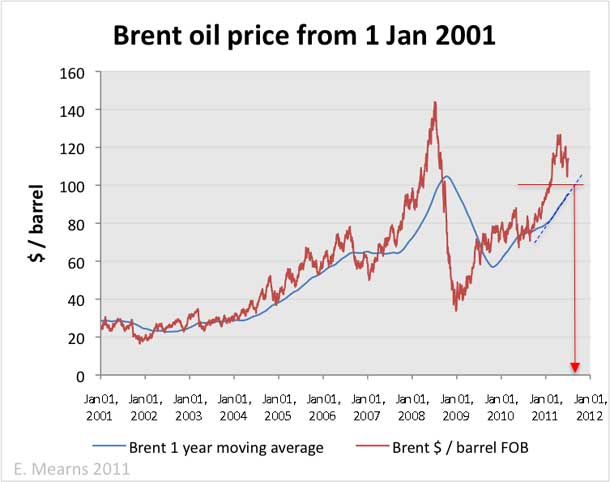

I have posted up-dated versions of this chart on several occasions now in recent months. The trend line, extending the 1 year moving average that points to $100 by September, is holding true. The 2008 high of $143.95 was posted on 3rd of July 2008. The Chinese Olympic games began on August 8th; on 15th September Lehman Brothers filed for Chapter 11 bankruptcy. The 2011 high (so far) is lower standing at $126.59 posted on 28th April. The sequence in 2008 / 09 was peak oil (price) financial crisis and then proper recession during 2009. That sequence of events began with the relatively small and unknown UK bank called Northern Rock that ran into initial trouble during August and September 2007. It is worth noting that the 2007-2009 crisis began with small fish but ended with whoppers.

Wider consequences

Indebted OECD countries like the UK (the USA, Spain and Italy) require strong economic growth to produce the tax revenue surplus to pay the interest on existing debts and to pay down the principal sums borrowed. Following the 2008 / 09 crash the return of strong growth that was wanted and needed has not materialised according to plan in many countries and there are just hints that the mainstream are beginning to appreciate the underlying problem, namely high energy prices. But here in lies the Catch 22. Strong economic growth, in an energy constrained world, will inevitably lead to higher energy prices, snuffing out the growth before prosperity can be delivered. Understanding the roots of the problem is the first step. Understanding how to tackle it, if it can be tackled, is a different matter. The recent move by the IEA to raid OECD strategic petroleum reserves for 18 hours worth of global oil consumption was a totally inept approach and futile attempt to tame oil prices that have been rampant ever since.

There are no simple solutions to this problem. But a good first step is to get much smarter in the way we use our remaining oil reserves and energy resources in general to deliver the energy services our economies require using vastly smaller sums of energy to do so.

The future

I have become wary of making forecasts. But as a statement of opinion I believe the world economy, and in particular certain major OECD economies, have slowed in the second quarter of 2011. Initial reports for the UK show growth stagnating at 0.1%. Respected economist and Financial Times Journalist Gavyn Davies also sees the Global Economy Still Weakening. In the UK, this will be blamed on cutting public spending and raising taxes too fast, but the reality is that we as a country continue to live well beyond our means and cannot afford to import ever larger amounts of expensive energy to power the leisure activities of our burgeoning retired population.

Stagnating growth in the UK will in great part be caused by unsustainably high oil prices that are now weakening though still strong - dragging the world economy toward the edge of the cliff. The intriguing story of high oil prices and recession is unfolding before our eyes and I will return to this subject on a regular basis in the months ahead lest anyone should say: "no one saw it coming".

Euan Mearns has BSc and PhD degrees in geology from the University of Aberdeen. Following 8 years in Norway as a researcher at the University of Oslo, he returned to Aberdeen in 1991 where he set up a geochemical analysis and consulting firm serving the international oil industry. For the last year he has been writing technical articles for The Oil Drum Europe.

Comments are not moderated. Please be responsible and civil in your postings and stay within the topic discussed in the article too. If you find inappropriate comments, just Flag (Report) them and they will move into moderation que.