Raghuram Rajan And Other Pied Pipers Of The New World Order

By Shelley Kasli

11 September, 2013

Countercurrents.org

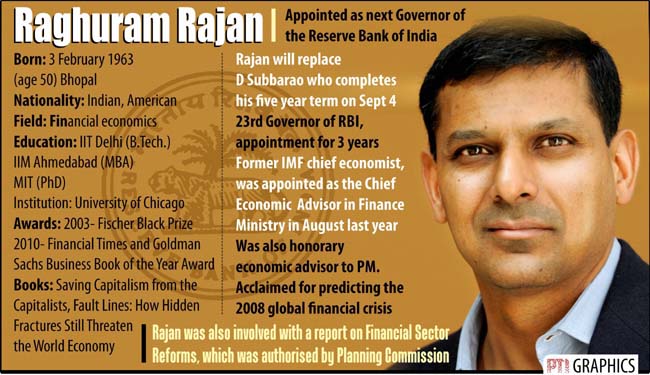

Welcomes don’t get much warmer than this—especially not for central bankers. But Raghuram Rajan, the new governor of the Reserve Bank of India, is being treated like a Rockstar by the media and a savior by the markets.

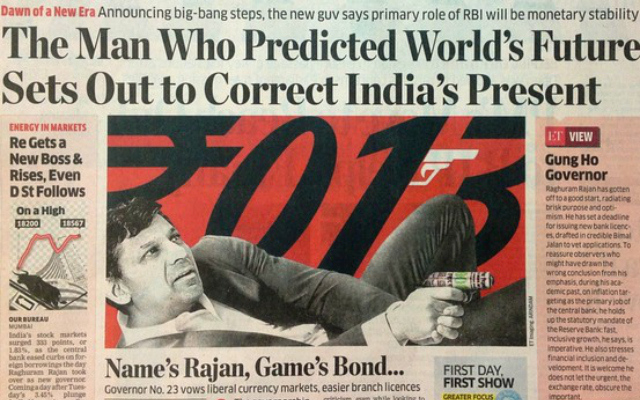

In his first briefing since taking office as governor on Sept. 4, Rajan announced plans to bolster the financial sector and support the rupee. None of the measures were ground-breaking, but the reaction was exuberant. The Economic Times, India’s leading financial newspaper, sketched Rajan as James Bond, replete with a sharp suit and a gun made out of rupee notes.

Nevermind his American citizenship nor the various prestigious organizations he is associated with such as University of Chicago, World Bank, US Federal Reserve Board, Swedish Parliamentary Commission, American Finance Association, International Monetary Fund (IMF) etc. However, one distinct accolade that he has earned is the entry into an elite group of economist czars called the Group of Thirty or just G30 very recently last year just before becoming the Bank Boss of India. For the scope of this article we’ll need to dwell a bit on the background of G30.

History of Group of Thirty G30

The Group of 30 is a Rockefeller-sponsored group of leading Central Bankers and academics a Washington, D.C. based institution which counts as its members many of the more powerful banks and financial institutions in the world. The Group of Thirty, chaired by former Federal Reserve Chairman Paul VoIcker, includes the current heads of the Bank of France, the Bank of Tokyo, the Bank of Italy, the Bank of Israel, the former head of the German Bundesbank and now even the Reserve Bank of India. Also represented are many of the top commercial and investment banks, including Citicorp, J.P. Morgan, Morgan Stanley, Merrill Lynch, Deutsche Bank, the Industrial Bank of Japan, and J. Rothschild International Assurance Holdings.

The Group of Thirty is, in short, a mouthpiece for the international financial operatives who created the speculative bubble that is now exploding. It is a sort of vampires’ club – an elite group which is planning the reorganization of the world monetary system.

Since late 1981, the IMF and the multinational financial oligarchies have realized that the developing countries would not be able to pay their debts under their original terms. The Group of Thirty, designed a strategy to use the debt crisis to smash sovereignty. Their perspective is to create a world council with executive powers to dictate and supervise financial policies of each “sovereign” nation to allow free reign for nation-less capital. This entity would be made up of the IMF and the central banks, act independently from national governments and be coordinated by the Bank for International Settlements, based in Basel, Switzerland.

This is the same group that outlined the plan for changing the laws and regulations of nations, in order to protect their derivatives trading and perpetuate the bubble as long as they can. One of the G30 benefactors is the Open Society Foundation, with upon further examination is a George Soros founded organization. Another of the G30 benefactors is the Whitehead Foundation, which was started by John C. Whitehead, the former managing partner for Goldman Sachs, and Deputy Secretary of State in the Reagan Administration.

G30 and more specifically former Fed Chairman Paul Volcker was the major player in moving the USD off the gold standard under Nixon and was the prime mover at the Treasury in establishing Bretton Woods II. Volcker and his buddies at the G30 have not only known about but have methodically planned the global monetary regime that was instituted in response to the Global Financial Crisis caused by the derivatives time bomb (see G-30 manual on derivatives published in 1993).

Now it shouldn’t come as a surprise to you when our Piped-Piper Raghuram Rajan played the tune on how the world will fall into a hole; one of the few who predicted the 2008 financial crisis. The question is – to what end ?

With the world’s financial system in the midst of the biggest blowout in modern history, it is useful to take a look at the latest proposals from the so-called financial experts, as a way of demonstrating their incompetence to devise a solution to a crisis for which they themselves are largely responsible.

In an interview given to The New York Times Mr Rajan explains his definition of growth and provides his solution to the ailing economy :

In terms of where will growth come from, it doesn’t need to come from fancy stuff like extraordinary innovation of one kind or another. Just getting people from agriculture into services and industry itself is growth.

I think India’s medium-term future is moving people out of agriculture into industry and services. Services, you know, some extent we have a sort of a sense of what it takes. And India’s service sector is disproportionately large for a country of its income. Where we have had less success is industry, and the question is can we sort of find a way to free the path for small and medium industry, and not just keep them forever as small and medium industries but allow them to grow into large industries.

In another interview given to The Economic Times he extrapolates it further :

There is a tremendous amount of value-add that can be created in services. In India, especially, financial services as also IT and others are where most value-add is created. Unfortunately, even though services account for 60% of the GDP, they don’t account for nearly as much for jobs. They account for just 15% of the jobs. What we need to focus on is perhaps thinking broadly about how we create services that will generate many more jobs.

Highlighting sectoral disparities building up in the economy, Rajan said in another interview to The Hindu Business Line that while agriculture’s share was declining, that of services had gone up. Manufacturing had remained flat.

“This is not surprising. As countries grow, agriculture declines. What is special about India is that the exit of people from agriculture has not kept pace. (no you’re not delusional; read again)

Increasingly, people in agriculture are impoverished relative to those having jobs in industry or service.

We managed to move the States together, but perhaps we need to do more on the sectoral side to move people out of agriculture into other areas

The ridiculousness of these statements is only complimented by the audacity with which it is said considering the fact that these conclusions are derived with a conviction and in full cognizance of their effects and consequences.

What is striking to me however is that I had heard this tune before. It’s enigmatic melody is so familiar to my ears that it’s been ringing in my head ever since. I had heard it play in what is called the Mecca of Book Lovers – the Jaipur Literature Festival by another piper that goes by the name of Ruchir Sharma; head of Emerging Markets and Global Macro at Morgan Stanley Investment Management and author of the international bestselling tune Breakout Nations: In Pursuit of the Next Economic Miracles.

I remember this distinctly because when questioned by me about the very definition of growth and the solutions for development he was talking about I received the very same answer from him. So similar was the tune that I had to sit up and take notice. Remember that these two are the top Indian thinkers on the Forbes list. So when they speak people listen to them unquestioned like words of God.

Nevermind that the Forbes family made their fortunes off of the Opium trade that was forcibly grown in India after ruining the agricultural lands and pushing the farmers into opium cultivation that was sold to the Chinese making their entire generations addicted onto it that made them unable to resist and fight when the time came during the Opium Wars; ultimately loosing Hong Kong to the Rothschild gang controlled East India Company. Hong Kong became the hub of Opium trafficking and later Hongkong and Shanghai Banking Corporation (HSBC Bank) was founded on the trafficking money to better launder and manage the booty. Forbes was one of the directors of HSBC and later founded the Forbes magazine as we all know. These are respected family names now.

These pipers are just playing their part in the symphony; the orchestra is being conducted from somewhere else. Have a look at this :

In India, the need of the hour is to bring 150 million workers out of agriculture and into manufacturing, which requires retraining and employment on a scale rarely seen. 174 million Indians are expected to join the labor force by 2030, the largest such cohort in the world, and training them will require a heavy dose of private-sector involvement.

This is right off Obama’s second term plans for India. Kindly read my analysis of it over here

Unlocking the full potential of the US-India Relationship 2013

The solution that he offers is to

Launch a “U.S.-India Job Creation and Skills Building Partnership”

Given that India’s economy could become the world’s third largest by 2030, and the U.S. economy is placing emphasis on retraining workers to meet the labor demands of the twenty-first century, a bilateral initiative should be launched to capitalize on the vast human capital in both societies, by linking the expertise and abilities of our community colleges and worker training programs. India’s Ministry of Human Resource Development has plans to focus on vocational training, but a concerted bilateral initiative, including public-private partnerships, to train and employ millions of workers for a modern economy is needed.

As hinted above this herculean feat of turning 15 crore farmers into worker slaves of the New World Order would require the privatization of our education system; one that could create NWO friendly worker bees. The steps towards this goal have already been implemented with Secretary Kerry’s visit to India.

The road to building skills for the 21st century

Remarks at the Higher Education Dialogue 2013 Kick-Off

U.S.-India Joint Fact Sheet: U.S.-India Cooperation In Higher Education

One of the outcomes of these strategic dialogues was IBM’s Project Praviin

The flag for revamping the entire Higher Education system in India by engaging the corporate sector in it through privatization is held by another piperNarayan Murthy.

Engaging the Corporate Sector Narayana Murthy Committee

This in itself would require a full post where I’ll be discussing in detail about theFuture of Higher Education in India.

This entire symphony is orchestrated on the Agriculture Manufacturing Services Growth Model which proposes:

Well agriculture is important, but manufacturing tends to be more productive per unit of labor. That is why it was the industrialized nations that became wealthy though the Industrial Revolution. The average wage and standard of living of a person in a country is then higher.

Also, agricultural economies are at the mercy of weather patterns, disease, and famines. Manufacturing economies have less outside variables to affect them. Service based economies are even more immune to fluctuations, because inventories don’t over accumulate, so the business cycle isn’t as volitile.

Agriculture cannot produce continuous economic GDP growth per capita because both the supply and demand is limited.

Now, there are serious holes in this theory the primary being that it doesn’t take into account that the Industrial Revolution was kick-started by plundering the raw materials, wealth and technology from the colonies which was again sold to the same colonies in Free Market. It’s not a co-incidence that the so-called Industrial Revolution started in Great Britain.

For more on this read my article Hidden Gears of the Industrial Revolution – How India made Britain ‘Modern’ !!!

Another supposition that this theory makes is that by dumping agriculture for manufacturing and services would result into more job creation and hence more GDP and economic growth. However the ground reports give a totally different picture.

Even at the peak of the economic growth period, between 2005 and 2009 when economy grew at 8 to 9 per cent, the high economic growth did not result in job creation.

According to a Planning Commission study, 14 million people were pushed out of agriculture, and another 5.3 million jobs were lost in the manufacturing sector in the same period. If growth was not translating into additional jobs, and instead was leading to increased joblessness, there was something going wrong.

Moreover

From the report by renowned Agriculture Scientist Devinder Sharma as published in Deccan Herald.

In the 9 years since Manmohan Singh took over, India has been flooded with cheaper manufactured goods, the imports touching $5 billion (Rs 3 lakh crore). Nearly 54 of the imports have come in from China alone. Much of the imports were of consumer goods that could have been easily manufactured within the country.

As if this is not enough, India is now having talks with China to sign a free trade agreement. In any case, India has been on a fast-track mode to sign bilateral trade agreements with more than 34 countries. The result: imports have far exceeded the exports from India, which means the trade agreements had not benefitted the country.

So, on one hand we’re being advised to dump our declining Agricultural Heritage for economic growth and increasing the GDP by shifting into manufacturing; while on the other bilateral trade treaties are being signed that would flood the Indian market with cheap foreign goods. Importing cheap and highly subsidized agricultural commodities as well as manufactured goods is like importing unemployment.

What I don’t understand is what would we be manufacturing than and for whom ? Further on the agenda is from manufacturing into services sector turning the population into just obedient slaves of Globalization.

This is what eminent writer Alan Watt has to say on Service Economy

ALAN WATT ON SERVICE ECONOMY

April 3, 2012 (#1057)

We’re all service economies. Which means you pass things around, once you bring them into the country. Or you go into the hotel industry and just hope you get enough managerial class Chinese to come over and rent rooms from you. I’m not kidding about this. This is what it’s all about, a service economy. Before they decided to bring the service economy into Britain, I can remember the debates about it. This was all in preparation because we’d already de-industrialized with an agreement with the United Nations at the end of WWII, and by the late 70s we were to be pretty well completely de-industrialized. Well, they really did it. They never told the public this. You had to go into the UN to find out, and from books written by people involved at the time. The newspapers never mentioned why you were being de-industrialized.

And millions were tossed out of work. Then they came out with this big massive propaganda program to go into service economies, service, and change sheets on beds and things, and that’ll be the new future. And you know, in Britain they’re still churning that rubbish out. I’ll get off that topic anyway. It upsets me

Alan Watt “Cutting Through The Matrix” LIVE on RBN

The more serious question is what will happen to the already declining agricultural sector and the impending food crisis suggested by various international and national reports ?

The Food Gap — The Impacts of Climate Change on Food Production: A 2020 Perspective

Alarm bells at crop summit: ‘Acute food scarcity in India by 2020’

But surely our Rockstar Pipers must have known this; they don’t expect us to feed on the worthless paper once the entire fiat monetary scam implodes from within – or do they ?

Lets see what India’s Agriculture Minister is doing about it.

A delegation of Punjab farmers led by India’s Agriculture MinisterSharad Pawar is currently (from Sept 3-13) on a visit to Brazil and Argentina looking for buying or leasing large tracts of land. According to news reports, Sukhbir Singh Badal deputy chief minister of Punjab is also part of the delegation. A farmer, who is cultivating over 30,000 hectares in Argentina, has already given a presentation to the members of the delegation.

Ironically, a recent report by the International Institute for Environment and Development (IIED) has brought out how small farmers in Brazil, for instance, are abandoning farming and swarming in to the urban centres. So on the one hand Brazil is driving away its own farmers, on the other it is inviting Indian farmers to come and cultivate the land left behind. What a flawed model of development? Your own farmers go landless while you handover farming to imported farmers.

http://devinder-sharma.blogspot.in/2010/09/after-offshoring-need-to-crack-whip-on.html

This is not just the case of Brazil. Whats going on is Global Farmland Graband India is one of the major proponents in this Neo-Colonizing drive. Isn’t it interesting, the same tune that the developed countries play for us developing countries; we play onto the third world countries.

Shelley Kasli is a geopolitical researcher for international English quarterly Inner Voice of Bharath, who writes articles specific to the Indian subcontinent in the global scenario. He can be reached at his blog at greatgameindia.wordpress.com or you can write directly to him at [email protected]

Comments are moderated