Strategic Petroleum Reserve Release: A Critical Look

By Stuart Staniford

27 June, 2011

Early Warning

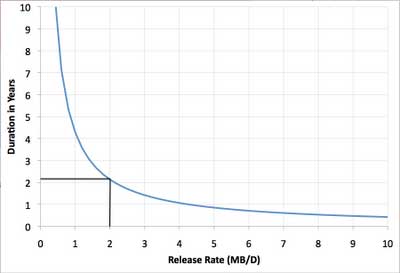

Here is the recent history of government controlled oil stocks in the OECD (ie the developed countries). The data comes from the EIA:

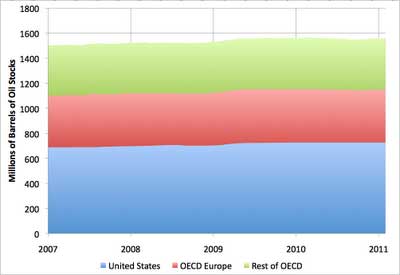

You can see that in total there's about 1500 million barrels held by western governments in strategic reserves. The US holds about half, Europe about a quarter, and the rest of the OECD the other quarter (Japan, Korea, Canada, Australia, etc). This next chart shows how long the total would last before running dry, as a function of the steady release rate:

The black lines indicate the level of yesterday's announcement, which called for a release of two million barrels/day, a rate that could be sustained for a little over two years. Initially, the call is to do this for thirty days, however:

International Energy Agency (IEA) Executive Director Nobuo Tanaka announced today that the 28 IEA member countries have agreed to release 60 million barrels of oil in the coming month in response to the ongoing disruption of oil supplies from Libya. This supply disruption has been underway for some time and its effect has become more pronounced as it has continued. The normal seasonal increase in refiner demand expected for this summer will exacerbate the shortfall further. Greater tightness in the oil market threatens to undermine the fragile global economic recovery.

In deciding to take this collective action, IEA member countries agreed to make 2 million barrels of oil per day available from their emergency stocks over an initial period of 30 days. Leading up to this decision, the IEA has been in close consultation with major producing countries, as well as with key non-IEA importing countries.

The IEA estimates that the unrest in Libya had removed 132 mb of light, sweet crude oil from the market by the end of May. Although there are huge uncertainties, analysts generally agree that Libyan supplies will largely remain off the market for the rest of 2011. Given this loss and the seasonal increase in demand, the IEA warmly welcomes the announced intentions to increase production by major oil producing countries. As these production increases will inevitably take time and world economies are still recovering, the threat of a serious market tightening, particularly for some grades of oil, poses an immediate requirement for additional oil or products to be made available to the market. The IEA collective action is intended to complement expected increases in output by these producing countries, to help bridge the gap until sufficient additional oil from them reaches global markets.

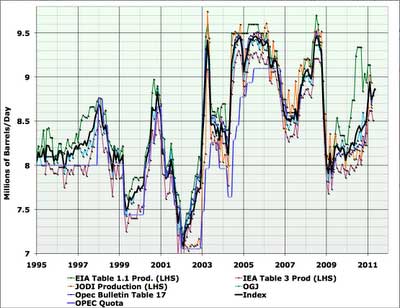

Emphasis mine. This is a rather interesting line or reasoning, to say the least. First of all, Libyan oil went off the market at the end of February, and it was instantly apparent (at least to me) that this would have economic consequences unless Saudi Arabia made up the difference (which it didn't). In fact it cut production slightly, and, at least on available statistics, has yet to make it back to the February production level:

So, now, here we are in late June, four months later, after a lot of the negative economic consequences have occurred, and the IEA has now decided to release 30 days worth of extra oil, until certain unnamed oil producers, presumably mainly Saudi Arabia, can increase production.

But why will this "inevitably take time"? According to the very same IEA just last week, "Effective spare capacity stands at 4.01 mb/d." Why can't this spare capacity be used right away? Or even three or four months ago, when the need first arose? And if it can't be used right away, how are we sure that it can be used in thirty days?

I don't know - maybe Saudi production will indeed increase, and this release from the SPR is a bridge to somewhere. It's going to be very interesting to watch the next few months of statistics. But there are sure a lot of strange loose ends here that don't seem easy to unravel. If it turns out to be a bridge to nowhere, then there are going to be hard choices between stopping the flow of oil (thus sharply raising prices again), or continuing to drain the strategic reserves for an indefinite length of time.

It is of course politically very attractive to release oil from the SPR and lower oil prices. According to the FT:

Indeed, the release is likely to have a far-reaching impact on the market in coming weeks and months. The market was already anticipating weaker prices due to the faltering economic recovery in the US and the arrival of extra production from Saudi Arabia. The release is well timed to add to any downward pressure on prices.

Bullish hedge fund traders were on Thursday reviewing their oil price projections. As David Kirsch, head of market intelligence at consultants PFC Energy, puts it, the release has changed the “oil market psychology” for now.

Until recently, the talk among traders was about the risk of prices moving back to $120 a barrel. Now, it is about whether Brent crude, the North Sea benchmark, will drop below $100.

David Greely, energy analyst at Goldman Sachs, immediately cut $10-$12 off his 3-month forecast, lowering it to $105-$107, while Hussein Allidina, head of commodities research at Morgan Stanley, said the release created a $10 a barrel downside risk to his $120 a barrel oil price forecast for 2011.

The challenge I see is this: if governments are not going to let their strategic reserves just permanently shrink, then at some point they are going to have to buy this oil back. Presumably that should be done when prices are lower than now (since the purpose of this sale is to lower them because they are too high). Unless the Saudi's really do show up with quite a bit more oil, that would seem to be a potentially challenging feat.

Stuart Staniford is a scientist and innovator in the technology industry, with a broad range of interests and experiences. He has a Physics PhD, MS in CS, and have done research, lived in cohousing communities, run a business, and designed technology products. Professionally, he mainly work on computer security problems and is currently Chief Scientist at FireEye He can be reached at stuart -- at -- earlywarn -- dot -- org. Early Warning is is his personal blog for pro-bono research, and FireEye has no responsibility for it

Comments are not moderated. Please be responsible and civil in your postings and stay within the topic discussed in the article too. If you find inappropriate comments, just Flag (Report) them and they will move into moderation que.